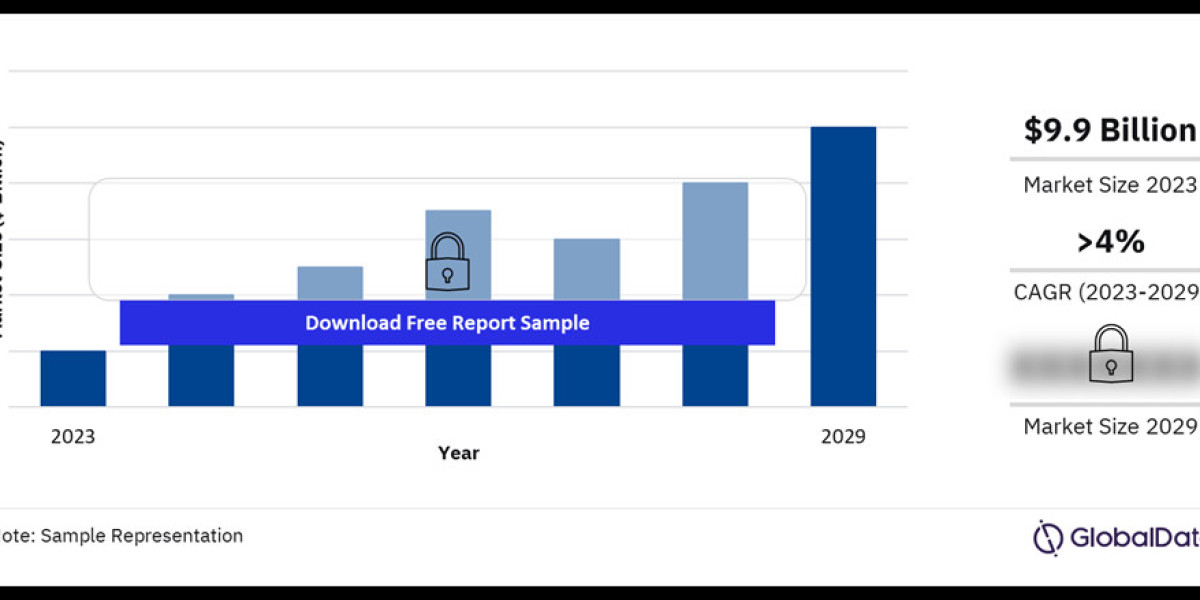

Whether you need capital to purchase equipment, rent premises, or develop a product, a business loan can be a crucial piece in getting your venture off the ground. This article covers everything you need to know about business loans for startups.

What Is a Business Loan?

A business loan is a form of financing where a bank, financial institution, or alternative lender provides capital in exchange for interest. The loan can be used for various needs, such as funding startup costs, purchasing inventory, or covering operational expenses. There are several types of business loans designed specifically for startups, including:

- Traditional Bank Loans: These offer low interest rates but often come with strict creditworthiness and collateral requirements.

- Government Loans and Grants: For example, organizations like Almi in Sweden provide financing to businesses with growth potential.

- Online Loans: Digital platforms like Lendo and Qred offer faster processes and less bureaucracy.

Why Do Startups Need Loans?

Startups often have limited resources and capital at the beginning. A business loan can help with:

- Covering Startup Costs: Renting premises, buying equipment, or hiring staff.

- Building Inventory: If you sell products, initial capital is needed to stock up.

- Marketing Efforts: Investing in digital campaigns or other promotional activities.

- Securing Cash Flow: Covering monthly expenses during the initial phase.

Having enough capital is essential to keep operations running smoothly and avoid unnecessary disruptions.

How to Apply for a Business Loan

Applying for a business loan might seem complicated, but proper preparation can make the process smoother. Follow these steps:

Create a Business Plan: This is the most important document, demonstrating how your business will generate revenue and grow. It should include your vision, goals, and a budget.

Gather Documentation: Lenders often require:

- A detailed business plan

- Budget and cash flow projections

- Collateral, if applicable

Compare Loan Options: There are many lenders on the market. Compare interest rates, repayment terms, and fees to find the best fit for your needs.

Submit Your Application: Apply online or at the lender's office. Be ready to answer questions about your business model and plans.

Advantages and Disadvantages of Business Loans for Startups

Advantages:

- Immediate access to capital for essential expenses.

- Builds a credit profile for future needs.

- Enables faster growth and investments.

Disadvantages:

- Higher interest rates and fees can strain finances.

- Collateral or personal guarantees may be required.

- Risk of excessive debt if revenues don’t grow as expected.

Tips for Successfully Managing a Business Loan

- Borrow Only What You Need: Avoid borrowing more than necessary to minimize interest costs.

- Monitor Cash Flow: Ensure you have a clear repayment plan.

- Build a Financial Buffer: Always have extra funds available for unexpected expenses.

- Seek Advice: Consult a financial advisor or mentor to help you make informed decisions.

Alternatives to Business Loans

If you prefer not to take a traditional loan, consider these alternatives:

- Venture Capital: Investments from individuals or funds in exchange for equity in your business.

- Crowdfunding: Raise money from the public via platforms like Kickstarter.

- Leasing: Rent equipment instead of buying it outright.

- Business Grants: Various organizations offer grants to startups.

Conclusion

A business loan can be vital for starting and running a successful venture. With proper preparation, shopping for the best terms, and considering alternative financing options, you can increase your chances of success with your startup idea. Do you want to learn more about navigating various financing options? Let me know, and I’ll guide you further!