Next-Gen Processing: AI Hardware Market Outlook 2033

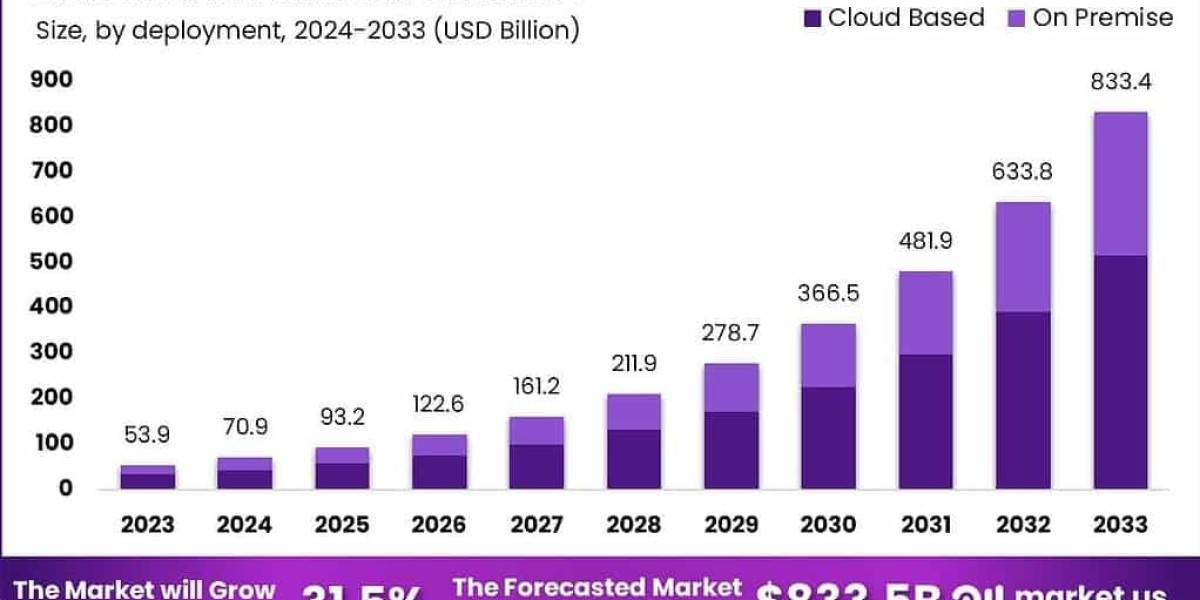

The global AI hardware market reached USD 53.9 billion in 2023 and is projected to grow at a robust CAGR of 31.5%, reaching USD 833.4 billion by 2033. This surge reflects escalating demand for high-performance computing, driven by AI applications across sectors like healthcare, automotive, and finance. North America dominated in 2023 with a 35.2% market share (USD 18.9 billion), underscoring its technological and infrastructural lead. Demand impact is significant, as industries prioritize real-time processing, edge AI, and power-efficient AI chips, fostering hardware innovation and integration. This rapid expansion reflects AI’s foundational role in future digital transformation.

Key Takeaways:

Market size to reach USD 833.4 billion by 2033

CAGR of 31.5% from 2024 to 2033

USD 53.9 billion market value in 2023

North America leads with 35.2% share (USD 18.9 billion)

Rising demand in edge AI, data centers, and autonomous systems

Dominant Market Position:

North America held a commanding 35.2% market share in 2023, valued at USD 18.9 billion. This dominance stems from early AI adoption, robust infrastructure, leading chip manufacturers, and significant R&D investments. The region is home to many startups and enterprise giants focusing on AI-centric computing platforms. U.S. government funding and commercial cloud infrastructure expansions further bolster this lead. Moreover, the presence of data-rich industries like autonomous vehicles, fintech, and biotech accelerates demand for dedicated AI hardware solutions. The region’s ecosystem encourages innovation, giving it a long-term strategic advantage in the AI hardware space.

Technology Perspective:

AI hardware is evolving with innovations in GPUs, ASICs, FPGAs, and neuromorphic chips. Emerging architectures now integrate AI accelerators for edge computing, reducing latency and energy consumption. High-bandwidth memory, advanced interconnects, and 3D chip stacking are revolutionizing compute efficiency. AI workloads are shifting towards edge deployments and privacy-centric inference, requiring compact yet powerful processors. Data center scalability demands advanced thermal solutions and parallelism. Vendors focus on AI-specific processors that deliver higher Tera Operations Per Second (TOPS), optimizing model training and inference. The integration of quantum and optical AI hardware is in early stages but shows future potential.

Dynamic Landscape:

The AI hardware market is shaped by rapid innovation, fierce vendor competition, and evolving computing demands. Startups challenge incumbents with purpose-built architectures, while hyperscalers invest heavily in custom AI chips to reduce dependence on third-party suppliers.

Driver, Restraint, Opportunity, Challenges:

Accelerated AI adoption and demand for faster compute drive growth. However, high initial investment and chip shortages restrain progress. Opportunities lie in edge AI and AI-on-chip innovations. Key challenges include power efficiency and supply chain vulnerabilities.

Use Cases:

AI inference in autonomous vehicles

Smart healthcare imaging and diagnostics

AI-powered industrial robotics

Edge-based facial recognition systems

Natural language processing acceleration

AI model training in hyperscale data centers

Key Players Analysis:

Leading players dominate through deep R&D, proprietary chip architectures, and vertical integration. They invest in hybrid AI accelerators and form strategic partnerships with cloud service providers and OEMs. Their portfolios span data center AI cores, edge AI chipsets, and inference engines tailored for diverse AI models. Many develop AI-specific SDKs, fostering software-hardware co-design. Players are also shifting towards sustainable hardware development to meet green data center goals. Collaboration with academic institutions and AI startups enables early access to next-gen algorithms, strengthening their competitive position. Their scale, innovation, and integration enable control over both performance and cost optimization.

Recent Developments:

Introduction of 3nm AI-specific chipsets

Launch of AI accelerators for edge servers

Strategic partnerships for AI chip design and fabrication

Investments in green semiconductor manufacturing

Custom chip rollouts by cloud service providers

Conclusion:

The AI hardware market is witnessing explosive growth, driven by the expanding role of AI across industries. With technological advancements in specialized processors and growing demand from edge and cloud computing, the market is poised for transformative evolution. Strategic innovation and regional investments will determine leadership.