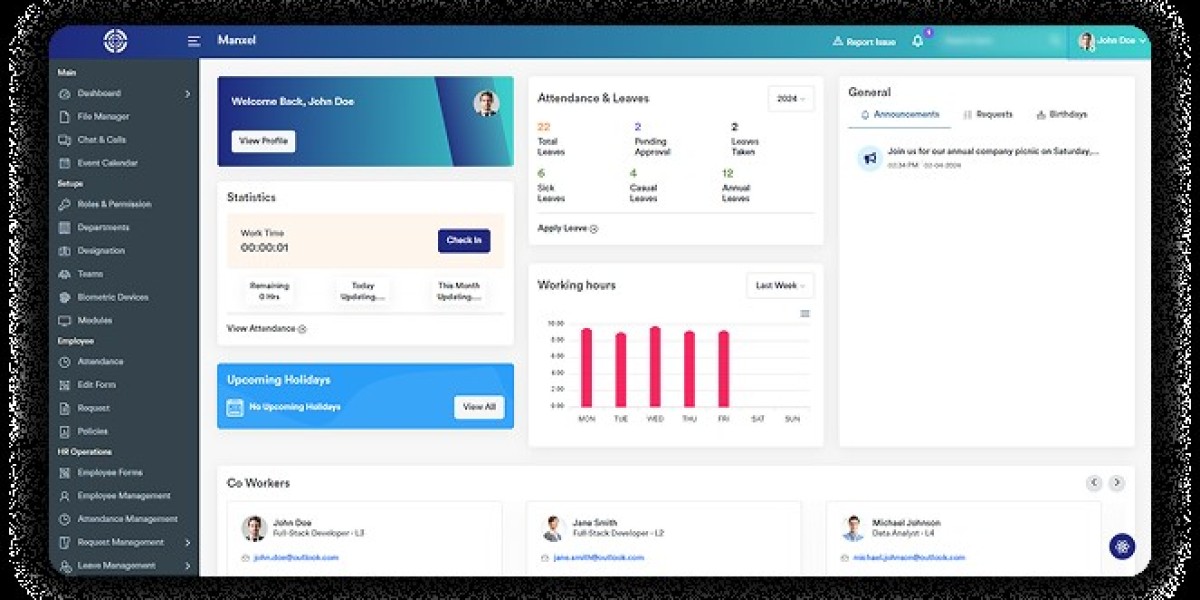

Growing businesses need flexible HR tools that evolve with them. MANXEL HRMS is built exactly for that — a cloud-based platform to streamline, automate, and scale HR operations.

Whether it’s managing leaves, running payrolls, or tracking performance, MANXEL brings structure and speed to every part of your HR department.

Why It Works:

✅ All-in-one HR dashboard

✅ Automation that saves hours weekly

✅ 24/7 accessibility and data security

✅ Great for teams of 10 or 1,000+

Discover why businesses trust MANXEL HRMS to power their people strategy.