Running a small business is no small feat. Between managing employees, handling customer needs, and keeping track of finances, business owners have their hands full. One of the most critical aspects of running a successful business is ensuring employees are paid accurately and on time. However, payroll processing can be complex and time-consuming. That’s where a free payroll check maker comes in.

This tool simplifies payroll management, saving small business owners time and effort. Instead of relying on expensive payroll services or struggling with manual calculations, a free payroll check maker helps business owners generate accurate payroll checks efficiently. Let’s explore how this tool can be a game-changer for small businesses.

Why Payroll Management Matters for Small Businesses

Payroll is more than just writing checks. It involves tracking hours, calculating deductions, withholding taxes, and ensuring compliance with labor laws. Even small errors can lead to financial issues, unhappy employees, or even legal troubles.

Many small businesses struggle with payroll because:

They don’t have a dedicated HR department.

Payroll software can be costly.

Tax regulations can be confusing and frequently change.

Manual calculations increase the risk of errors.

Using a free payroll check maker can alleviate these challenges by offering an easy and cost-effective solution for generating accurate payroll checks.

How a Free Payroll Check Maker Works

A free payroll check maker is an online tool that allows business owners to create payroll checks quickly. Here’s how it typically works:

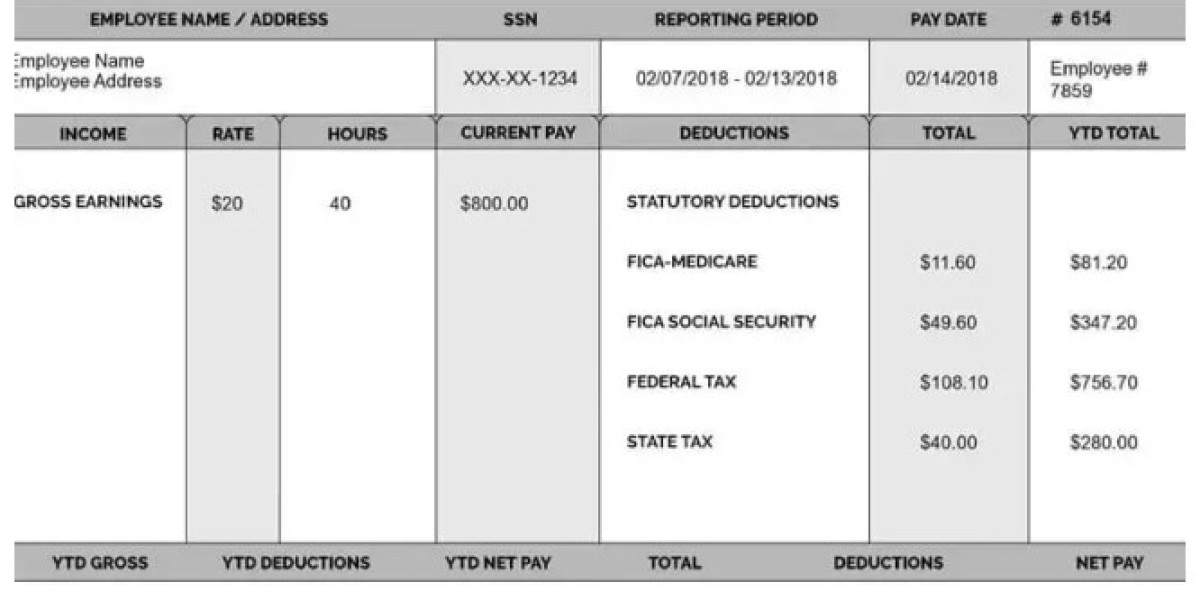

Enter Employee Information – Input details such as employee name, pay period, hours worked, hourly rate, or salary.

Calculate Deductions – The tool automatically deducts taxes, Social Security, Medicare, and any other required amounts.

Generate Paychecks – The payroll check is created instantly, ready to print or distribute digitally.

Save Records – Many tools allow you to store payroll records for future reference.

Benefits of Using a Free Payroll Check Maker

1. Saves Time and Effort

Manually calculating payroll is tedious and time-consuming. A free payroll check maker automates the process, allowing business owners to focus on growing their business rather than crunching numbers.

2. Reduces Payroll Errors

Incorrect payroll calculations can lead to compliance issues and employee dissatisfaction. A payroll check maker minimizes human errors by automating tax deductions and calculations.

3. Cost-Effective Solution

Hiring a payroll service or accountant can be expensive. Using a free tool eliminates these costs while still ensuring payroll accuracy.

4. Easy to Use

Most free payroll check makers have user-friendly interfaces, making them accessible even for business owners with little payroll experience.

5. Ensures Compliance

Staying compliant with payroll laws is crucial to avoid penalties. A payroll check maker helps ensure the correct tax deductions and contributions are made.

6. Convenient Record-Keeping

Many payroll check makers allow you to save payroll records, making it easy to track employee payments and generate reports when needed.

Who Can Benefit from a Free Payroll Check Maker?

A free payroll check maker is beneficial for various small business owners, including:

1. Freelancers and Self-Employed Professionals

If you’re a freelancer or self-employed, paying yourself correctly is important. A payroll check maker can help you keep track of your income and deductions for tax purposes.

2. Small Business Owners with a Few Employees

For businesses with a small team, a full-scale payroll system may be unnecessary. A free payroll check maker offers a simpler alternative.

3. Contractors and Gig Workers

Independent contractors and gig workers can use payroll check makers to generate pay stubs for record-keeping and proof of income.

4. Startups on a Tight Budget

New businesses often operate with limited funds. A free tool helps startups manage payroll without additional expenses.

5. Businesses in Service Industries

From cafes and retail stores to cleaning services and beauty salons, businesses with hourly employees can benefit from the efficiency of a payroll check maker.

How to Choose the Best Free Payroll Check Maker

There are several free payroll check makers available online. When choosing the right one for your business, consider the following factors:

Ease of Use – Look for a simple, intuitive interface.

Accuracy – Ensure the tool calculates taxes and deductions correctly.

Security – Since payroll involves sensitive information, choose a secure platform.

Customization Options – A good tool should allow customization for different pay rates, deductions, and benefits.

Record-Keeping Features – Some tools offer options to save and print payroll records for future reference.

Steps to Implement a Free Payroll Check Maker in Your Business

Research and Select a Tool – Find a reliable and user-friendly payroll check maker.

Gather Employee Details – Collect necessary information like work hours, pay rates, and tax details.

Set Up Payroll – Input the data into the tool and generate payroll checks.

Review Before Issuing – Always double-check calculations to ensure accuracy.

Distribute Payroll Checks – Print or send digital copies to employees.

Maintain Payroll Records – Keep records for tax filing and compliance purposes.

Conclusion

Managing payroll doesn’t have to be complicated or expensive. A free payroll check maker offers small business owners a simple, reliable, and cost-effective solution to ensure employees are paid accurately and on time. By using this tool, business owners can save time, reduce errors, and maintain compliance with payroll laws.

If you’re a small business owner looking for an efficient payroll solution, consider using a free payroll check maker today. It’s a smart way to simplify your payroll process and keep your business running smoothly.

Related Articles

Access Your Pay Information Using eStub in 2025

TruBridge Paystub Not Showing? Here’s What to Do

Why Employer Should Use a Free Payroll Check Stubs Template?

Role of Financial Management in Creating a Stable Paycheck