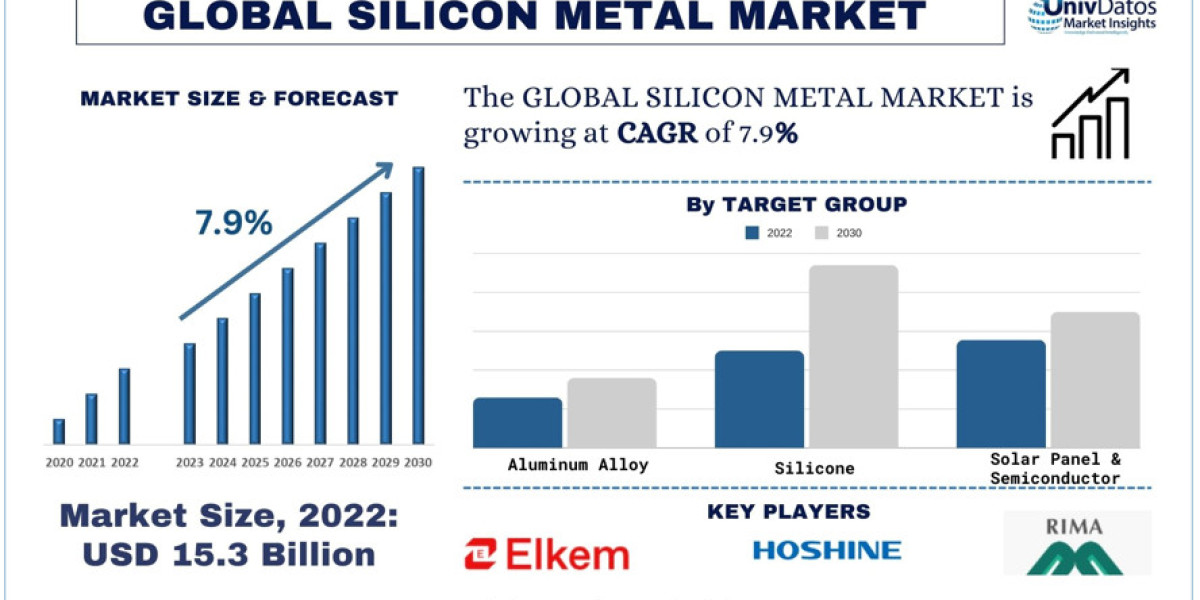

According to the UnivDatos Market Insights, the rising sales of solar panels and increasing investment in semiconductor products will drive the global scenario of the Silicon Metal market and as per their “Silicon Metal Market” report, the global market was valued at USD 15.3 Billion in 2022, growing at a CAGR of 7.9% during the forecast period from 2023 - 2030 to reach USD 29.2 Billion by 2030. Silicon is a hard, brittle crystalline solid with a blue-grey metallic luster, classified as a non-metal and semiconductor. High-purity silicon metal is utilized in various industries, including the chemical industry for producing silicon compounds and silicon wafers used in electronics. Silicon metal is abundant in the Earth's crust, with silicates and silica being major components. This grey and lustrous semi-conductive metal is commonly used in the manufacturing of steel, solar cells, and microchips.

Access sample report (including graphs, charts, and figures): https://univdatos.com/get-a-free-sample-form-php/?product_id=56832

Demand for Silicon Material is Exponentially Rising

The silicon metal market is witnessing increased production driven by strong demand in sectors like silicones, aluminum, and semiconductors, with potential growth in Si-anode Li-ion batteries. However, the ferrosilicon market has been declining since 2011 due to reduced demand, likely influenced by the use of lower grades of FeSi in steels despite global steel demand growth. Short-term stress on raw materials is mitigated by convertible FeSi capacities to Si capacities and large overcapacities, especially in China.

Key obstacles to increasing silicon metal production include high energy requirements (11-14 kWh/kg Si), rising raw material costs, and significant environmental impacts from fossil fuel use (coal, lignite, coke). The market faces challenges such as labor and transportation costs contributing to production expenses and the energy-intensive purification process required for silicon metal production. The high production costs limit market growth potential.

Market participants are focusing on advancements, R&D investments, and sustainability to drive future growth. Asia-Pacific leads the global silicon metal market, with significant revenue share attributed to industrial development in countries like China, Japan, and India.

Rising End-User segments Leading the Demand

· The automotive industry is trending in the direction of smaller and lighter cars, as to increase fuel efficiency. This bodes well for the silicon market, as silumin, a combination of aluminum and silicon, is relatively light, and can be used as a replacement for heavy cast iron and steel car components.

· The solar industry, which has exploded in growth in the past decade, represents another major opportunity for silicon metal producers. Silicon is a primary component in solar cells, as the metal’s semi-conductive status enables the photovoltaic process of converting sunlight into electricity.

· Micro-computer chips, or silicon wafers, are used for the fabrication of integrated circuits. As the electronic market continues to grow, so will the demand for silicon metal.

Limited Supply of Silicon Metal

In 2020, the global silicon metal production capacity reached 6.5 million mt, with 1.33 million mt overseas and 5.17 million mt in China. Over the period from 2013 to 2020, global industrial silicon capacity increased by 1.85 million mt, with China contributing 1.72 million mt. Global silicon metal output in 2020 was 3 million mt, including 0.8 million mt overseas and 2.2 million mt in China. During the same period, global silicon metal production rose by 0.71 million mt, with China contributing 0.7 million mt, solidifying its position as a leading producer and supplier of silicon metal with growth potential.

The limited supply of silicon metal has raised concerns across industries due to its impact on prices and availability. Recent surges in silicon prices, with a 300% increase in less than two months, have caused disruptions in the world economy affecting sectors like car parts and computer chips. This scarcity is primarily due to disruptions in silicon metal output caused by electricity curbs in China, leading to force majeure declarations on silicone products. The global production and supply of silicon metal are influenced by market forces, economic crises, and production disruptions, as evidenced by recent events affecting prices and availability.

Increasing Silicon Prices

According to Aranca, During 2021–22, prices of silicon metal surged by 3–4x compared with 2020, majorly driven by limited supply and increased demand. As the production of silicon metal is an energy-intensive process, the energy rationing in China and surging energy costs in Europe had a negative impact on global supplies. Furthermore, rising demand of silicon metal for multiple applications, including solar cells, contributed to the price rise. However, prices started declining from 4Q22 and reduced substantially by 60–70% in the past two quarters owing to improved supply and weak demand, but partially offset by demand from the solar industry.

Prices of metallurgical grade silicon increased by 3x to USD6,000–9,000/MT (metric tonne) in 2022 from USD2,000–3,000/MT in 2021. This escalation was majorly attributed to the increase in supply deficit to more than 1 million MT, impacted by the electricity regulations imposed in China (leading silicon metal producing and exporting country across the globe) and high energy cost in Europe. Moreover, a double-digit growth in demand over this period was contributed by silicone, semiconductor, solar cell, and lithium-ion rechargeable battery industries, which fuelled price hikes.

Impact on end-user Industries

Due to the rise in prices of silicon metal, end-use companies raised the prices of end-products. For instance, Wacker Chemie AG, a leading silicone manufacturer, increased the prices of end-products (fluids, emulsions, resins, elastomers, sealants, silanes, silane-terminated polymers, and pyrogenic silica) by 20─30% from mid-2021. Shin-Etsu increased prices of silicones by 10% from May 2022. In addition, many end-use companies are collaborating with silicon manufacturers to secure long-term supply to mitigate supply challenges. However, the scenario changed during 2022–23 due to the decline in prices of silicon metal.

Click here to view the Report Description & TOC https://univdatos.com/report/silicon-metal-market/

Conclusion

In conclusion, the Silicon Metal market is experiencing significant growth and is projected to continue expanding. Factors driving this growth include the demand for silicon metal in solar panels. The market is influenced by the increasing investment in solar renewable energy. However, the supply isn’t able to catch up to the increasing demand which has led prices to skyrocket.

Related Mining & Machinery Market Research Report

Precision Gearbox Market: Current Analysis and Forecast (2024-2032)

Cotton Candy Machines Market: Current Analysis and Forecast (2024-2032)

Street Cleaning Machines Market: Current Analysis and Forecast (2024-2032)

Micro Injection Molding Machine Market: Current Analysis and Forecast (2024-2032)

Contact Us:

UnivDatos Market Insights

Contact Number - +19787330253

Email - contact@univdatos.com

Website - www.univdatos.com

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/