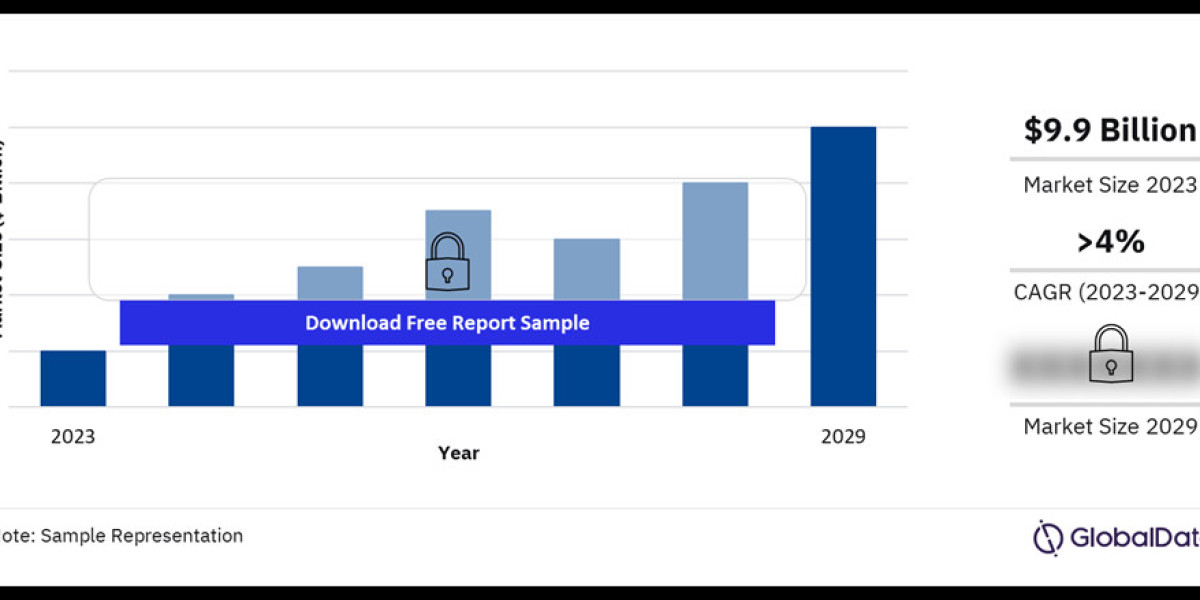

Digital lending platforms market are online platforms that use technology, such as artificial intelligence (AI), machine learning (ML), and big data analytics, to offer loans. These platforms simplify the borrowing process, offering customers quick, easy access to funds without the traditional involvement of brick-and-mortar banks. Digital lending platforms serve various segments, including personal loans, business loans, student loans, and even mortgage lending.

Buy the Full Report for More Insights on Digital Lending Platforms Market Forecast, Download a Free Report Sample

Key Drivers of Market Growth

Technological Advancements: The increasing integration of AI, blockchain, and big data analytics has made it easier for digital lenders to evaluate creditworthiness, assess risk, and offer personalized loan products. These technologies allow lenders to offer loans faster, with reduced manual processes.

Consumer Demand for Convenience: The demand for more convenient, faster, and transparent financial services is propelling the growth of digital lending. Consumers prefer the ease of applying for loans online with minimal documentation, compared to the traditional loan process that often involves paperwork and face-to-face interactions.

Increased Financial Inclusion: Digital lending platforms play a crucial role in expanding access to financial services, especially in underserved regions. By leveraging mobile phones and internet access, lenders can reach customers who have limited access to traditional banking systems.

Regulatory Support: Many countries have introduced regulations that encourage the growth of digital lending, ensuring that these platforms operate in a safe, transparent, and accountable manner. This regulatory environment provides stability and fosters trust among consumers and investors.

Trends Shaping the Digital Lending Market

AI and Machine Learning Integration: AI is increasingly being used to assess the creditworthiness of borrowers, predict loan defaults, and detect fraudulent activities. The use of machine learning algorithms to analyze large datasets allows digital lenders to make more accurate lending decisions and offer customized loan products.

Peer-to-Peer Lending: Peer-to-peer (P2P) lending platforms have gained traction as an alternative to traditional lending institutions. By connecting borrowers directly with individual investors, these platforms cut out intermediaries, potentially offering lower interest rates for borrowers and better returns for lenders.

Blockchain Technology: Blockchain offers a decentralized, secure platform for digital lending. It enables quicker loan disbursement, reduces fraud, and allows for transparent transactions, which has led to an increased interest in blockchain-based lending platforms.

Embedded Finance: Another growing trend is the integration of lending services into non-financial platforms. For instance, e-commerce websites, fintech apps, and mobile wallets are now offering embedded lending products, making it easier for consumers to access loans without leaving the platforms they already use.

Buy Now, Pay Later (BNPL): BNPL services have surged in popularity, especially for small-ticket consumer goods. This model allows customers to make purchases and pay in installments, offering an attractive alternative to credit cards and traditional loans.

Challenges Facing the Digital Lending Market

While digital lending has shown immense potential, it faces a few challenges:

Data Privacy and Security: The handling of sensitive customer data is a concern. Digital lenders need to ensure robust cybersecurity measures to protect against data breaches and fraud.

Regulatory Uncertainty: The regulatory landscape for digital lending is still evolving in many countries. Changes in regulation could impact business models and market growth, making it crucial for platforms to stay informed and comply with new laws.

Credit Risk and Loan Default: Despite advances in technology, assessing borrower risk can still be challenging, especially for individuals with limited credit histories. This poses a risk to digital lenders in terms of loan defaults and non-performing assets.