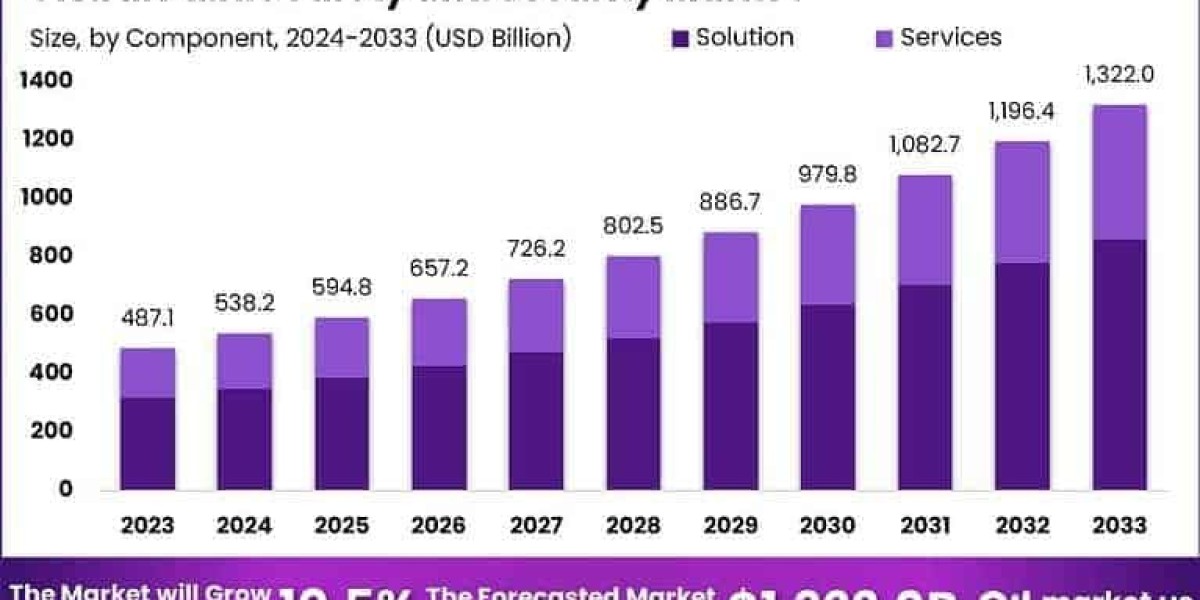

The Global Public Safety and Security Market was valued at USD 487.1 billion in 2023 and is projected to reach USD 1,322.0 billion by 2033, expanding at a CAGR of 10.50%. This growth is driven by rising threats of terrorism, cyberattacks, natural disasters, and increasing public safety needs across urban and critical infrastructure settings. The demand for advanced surveillance, emergency response systems, and cybersecurity solutions is propelling market expansion. Growing adoption of AI-driven analytics, smart city initiatives, and integrated communication platforms are further strengthening global investments in resilient public safety and homeland security solutions.

Key Takeaways

Market size (2023): USD 487.1 Billion

Forecasted size (2033): USD 1,322.0 Billion

CAGR (2024–2033): 10.50%

North America share: 38.3%, with USD 186.5 Billion in 2023

Growth fueled by urbanization, smart cities, and AI integration

Heightened demand for real-time surveillance and emergency response

Cybersecurity segment witnessing exponential growth

Governments investing in national safety infrastructure

Dominant Market Position

North America dominated the public safety and security market in 2023 with a 38.3% share, generating USD 186.5 billion in revenue. This leadership stems from established emergency communication systems, strong cybersecurity infrastructure, and continuous federal and state-level investments in public protection. The region’s adoption of smart surveillance, 5G-based communication for first responders, and predictive policing systems positions it at the forefront of public safety innovation. High urban density, critical infrastructure, and government mandates for citizen safety drive sustained demand. Meanwhile, Asia-Pacific is emerging rapidly, driven by population growth, smart city initiatives, and cross-border security concerns.

Technology Perspective

Technological innovation is transforming public safety with AI-powered surveillance, big data analytics, real-time geospatial intelligence, and integrated command and control platforms. The deployment of next-gen 911 systems, body-worn cameras, and automated drones enhances situational awareness. Cybersecurity technologies are rapidly evolving to defend against digital threats targeting national and civil systems. Cloud-based infrastructure enables scalable, collaborative emergency management, while IoT and edge computing are facilitating faster response times in real-time crisis environments. Integration of AI and ML into threat detection, behavior analysis, and crowd monitoring is revolutionizing law enforcement and disaster response operations globally.

Dynamic Landscape

The market features strategic partnerships between governments and tech firms, rapid digitalization of public infrastructure, and regulatory reforms enhancing safety protocols across regions.

Drivers, Restraints, Opportunities, Challenges

Driver: Growing threat of cybercrime, terrorism, and climate-related disasters

Restraint: High implementation and maintenance costs

Opportunity: Rise of AI, smart cities, and digital command centers

Challenge: Interoperability and data privacy concerns in public systems

Use Cases

Video surveillance for public areas and transit systems

Emergency communication networks for disaster response

Cybersecurity for public infrastructure and databases

AI-powered predictive policing and crime mapping

Smart city integration for real-time incident management

Biometric access control for government and border facilities

Key Players Analysis

Leading market players focus on developing integrated safety solutions combining physical security, digital defense, and emergency response capabilities. They invest in AI, cloud, and geospatial analytics to provide real-time threat detection and operational coordination. These companies often partner with national governments and urban agencies to support smart city infrastructure and command centers. Their solutions address both physical threats and cyber risks through unified platforms. Expansion into developing regions, modular system design, and compliance with national safety standards are core strategies. Competitive differentiation is achieved through innovation in real-time data visualization, interoperable communication, and end-to-end security services.

Recent Developments

Launch of AI-based threat recognition platforms

Upgrades to integrated emergency management systems

Deployment of 5G-enabled public safety networks

Partnerships to enhance national cybersecurity resilience

Introduction of cloud-based public safety command suites

Conclusion

The global public safety and security market is evolving rapidly in response to modern threats and digital transformation. With rising investments in AI, cybersecurity, and integrated emergency infrastructure, the sector is set to play a crucial role in ensuring societal resilience. Regional expansions and technological innovation will define future growth.