Industry Overview

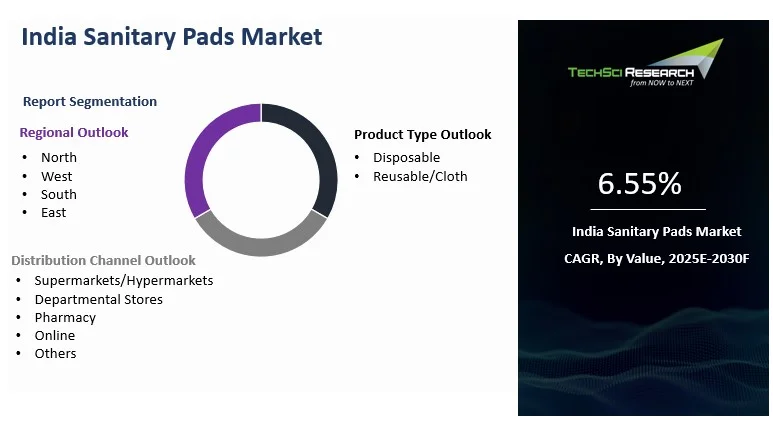

The India Sanitary Pads Market is evolving into a dynamic and transformative segment of the feminine hygiene landscape. Once veiled in social stigma and hushed discussions, menstrual hygiene has now become a national priority. Valued at USD 828.65 million in 2024, the market is forecast to reach USD 1212.58 million by 2030, growing at a healthy CAGR of 6.55% during the forecast period.

This transformation is not just a result of commercial penetration but an indicator of social progress and public health awareness. Factors such as increasing literacy among women, active participation in the workforce, and significant efforts by the government and NGOs have played a pivotal role in dismantling taboos and opening doors to menstrual hygiene accessibility for women across urban, semi-urban, and rural India.

Industry Key Highlights

Market Valuation (2024): USD 828.65 million

Forecast Valuation (2030): USD 1212.58 million

CAGR (2024–2030): 6.55%

Top Growing Region: South India

Dominant Retail Channel: Supermarkets/Hypermarkets

Major Market Segments: Disposable and Reusable Pads

Key Trends: Sustainable menstruation, digital retail expansion, menstrual education, stigma reduction

Target Demographics: Women aged 10–50, particularly students, working professionals, and rural women

Key Players: P&G, Johnson & Johnson, Unicharm, Nua, Sirona, Azah

Download Free Sample Report - https://www.techsciresearch.com/sample-report.aspx?cid=7472

Market Drivers

1. Evolving Social Norms and Awareness

The once-taboo subject of menstruation is now being embraced as a crucial public health issue. The Indian government's bold initiatives, such as the Menstrual Hygiene Scheme, Swachh Bharat Mission, and campaigns like #PeriodOfChange, have educated millions about safe menstrual practices. Schools, healthcare workers, NGOs, and brands have joined hands to mainstream menstruation—empowering young girls to speak up and make informed choices.

2. Rising Female Literacy and Workforce Participation

As more women and girls enter the education system and labor force, menstrual hygiene becomes a necessity, not a luxury. Girls who once dropped out of school due to lack of access to menstrual products are now staying enrolled, thanks to low-cost or subsidized sanitary pads. Working women demand convenience, comfort, and hygiene—all of which modern sanitary pads offer.

3. Infrastructure and Urbanization

India’s growing urban landscape—marked by expanding cities, improved transport, and widespread retail access—is enabling women to access menstrual products more easily. Additionally, improved sanitation infrastructure and disposal systems encourage wider adoption of sanitary pads, particularly in semi-urban and Tier II & III towns.

4. Innovations in Product Design and Materials

From organic cotton pads to biodegradable packaging, brands are innovating in response to rising consumer demand for safer, more skin-friendly, and environmentally responsible products. Pads are now thinner, more absorbent, leak-proof, and tailored for various body types and flow intensities.

5. Brand Campaigns and Influencer Advocacy

Marketing has evolved from whispering in the background to shouting from the rooftops. Brands are using inclusive, relatable, and fearless narratives to connect with consumers—whether it's real stories of menstruating athletes or animation videos teaching girls about their first period. Influencers and health professionals are also playing an instrumental role in normalizing conversations around periods.

Emerging Trends in the India Sanitary Pads Market

1. Green is the New Red: Eco-Friendly Menstrual Products

Consumers are increasingly conscious of sustainability and eco-footprints. Brands are now offering biodegradable pads, reusable cloth pads, and organic cotton products that are both effective and environmentally sound. This shift is especially popular among urban millennials and Gen Z consumers.

2. Rise of Reusables and Period Poverty Solutions

Startups and NGOs are championing low-cost, reusable pads to combat period poverty. These alternatives, made from cloth or bamboo fiber, are washable and last for up to 2 years—offering a sustainable and affordable solution for low-income populations.

3. E-Commerce and Subscription Models

With the digital wave sweeping across India, online platforms like Nykaa, Amazon, and Flipkart have become key sanitary pad distributors. Many brands now offer subscription-based deliveries, customizable period kits, and confidential packaging, providing discreet and convenient solutions for busy consumers.

4. Menstrual Health Education via Digital Tools

Digital literacy is leading to a more informed user base. Interactive period trackers, educational videos, and teleconsultations with gynecologists are equipping women with the knowledge to make better menstrual health choices.

5. Inclusivity in Product Messaging and Design

Brands are increasingly focusing on inclusivity—gender neutrality, body positivity, and socio-economic diversity. Campaigns now portray menstruation as a universal human experience, breaking barriers and making products more acceptable across varied demographics.

Segmental Insights

By Product Type: Disposable Leads, Reusables Rise

Disposable Pads: Currently dominate due to widespread availability, ease of use, and familiarity.

Reusable/Cloth Pads: Gaining popularity for their eco-friendly appeal, long-term cost efficiency, and support from sustainability advocates.

By Distribution Channel: Supermarkets/Hypermarkets Take the Lead

Large-format retail chains like Big Bazaar, Reliance Smart, and D-Mart offer:

Broad brand variety (premium to economy)

Product bundling and discounts

Discreet buying experience

Frequent promotional campaigns and samples

These outlets appeal particularly to urban and semi-urban women who seek convenience, choice, and price sensitivity under one roof.

By Region: South India is the Fastest Growing Market

States like Tamil Nadu, Kerala, Karnataka, and Andhra Pradesh are at the forefront due to:

Higher literacy and health awareness

Stronger government health programs

Advanced retail and healthcare infrastructure

Higher levels of urbanization and purchasing power

For example, Tamil Nadu boasts more than 90% usage among menstruating women due to its successful integration of menstrual hygiene education in public health efforts.

Competitive Analysis

The Indian sanitary pads market features a mix of global giants, regional champions, and agile startups. Competitive intensity is high, with brands competing on pricing, technology, comfort, and brand trust.

Key Players and Strategic Highlights

Procter & Gamble (Whisper)

Market leader with deep rural penetration

Focus on education campaigns like Whisper’s "Touch the Pickle"

Wide product portfolio across price segments

Johnson & Johnson (Stayfree)

Known for comfort-focused pads and youth-targeted branding

Strong offline distribution channels

Unicharm (Sofy)

Focus on ergonomic designs and overnight pads

Leveraging Japanese technology for better absorbency

Kimberly-Clark (Kotex)

Premium segment positioning

Emphasis on product innovation and lifestyle marketing

Lagom Labs (Nua)

Subscription-based online platform

Offers toxin-free, customizable sanitary kits

Sirona Hygiene

Hybrid model offering menstrual cups and natural pads

Strong D2C presence and aggressive influencer marketing

Azah Personal Care

Organic cotton pads with biodegradable wrappers

Targets eco-conscious urban consumers

Wet & Dry Personal Care

Strong hold in intimate hygiene space

Building synergy across product verticals

Shudh Plus Hygiene

Focus on budget-friendly pads for rural penetration

Future Outlook

The India Sanitary Pads Market is not just growing—it is evolving. As India marches toward its vision of universal health coverage and gender equity, menstrual hygiene will play a crucial role in enabling dignity, freedom, and participation for women across all walks of life.

Key future developments include:

Deeper rural penetration through government and NGO collaborations

Expansion of menstrual health literacy in schools and communities

Greater integration of sanitary pads into healthcare and CSR programs

Emergence of smart pads with odor control and real-time tracking capabilities

Continued brand diversification to include trans men, non-binary individuals, and differently-abled users

This transformation, however, requires sustained focus on affordability, accessibility, education, and cultural sensitivity. With collaboration among public, private, and civil society players, the market holds the potential to transform not only business metrics but also the lives of millions of Indian women.

10 Benefits of the Research Report

Accurate Market Forecasting: Helps investors and companies understand potential growth areas till 2030.

Comprehensive Segmentation: Breaks down the market by product type, channel, and geography.

Emerging Trends Unveiled: Offers insights on sustainability, digital transformation, and inclusivity.

Consumer Behavior Insights: Details how demographics and awareness are shaping buying patterns.

Competitive Intelligence: Understand key players’ strategies, positioning, and market share.

Region-Wise Breakdown: Identifies high-performing states and regions with the fastest growth.

Distribution Channel Analysis: Evaluates the performance of online and offline retail formats.

Policy Impact Assessment: Tracks how government initiatives are affecting supply and demand.

Investment Opportunity Mapping: Identifies untapped rural markets and niche product segments.

Customizable Data: Offers 10% customization for stakeholders needing tailored insights.

The India Sanitary Pads Market is a testament to the power of awareness, innovation, and social progress. As cultural norms evolve and consumers demand healthier, safer, and more responsible products, sanitary pads are not just hygiene tools—they’re instruments of empowerment.

From teenage girls in school to working women in metro cities, access to sanitary pads ensures education, productivity, dignity, and health. The path ahead involves tackling affordability, sustainability, and education—challenges that also represent tremendous opportunities for brands, policymakers, and changemakers alike.

With strategic collaborations and a focus on inclusive growth, the India sanitary pads market is set to become a global case study in menstrual health transformation.

Contact

TechSci Research LLC

420 Lexington Avenue, Suite 300,

New York, United States- 10170

Tel: +1-332-258-6602

Website: www.techsciresearch.com