Managing accounts payable efficiently is vital to maintaining a healthy cash flow and strong vendor relationships. However, many businesses across the USA still rely on outdated manual processes that consume time, introduce errors, and reduce operational transparency. To address these challenges, more companies are now adopting smart AP automation services that drive speed, accuracy, and cost savings across their financial operations.

IBN Technologies provides intelligent and scalable automation services for accounts payable to businesses across the USA. Our automation solutions are designed to handle everything from invoice data capture to multi-level approval workflows and payment scheduling, ensuring your AP department becomes a value-adding function rather than a cost center.

The Rising Need for AP Automation in the USA

With the shift toward digital transformation, organizations in the USA are under increasing pressure to streamline their back-office functions. Manual invoice handling, paper approvals, and siloed systems hinder real-time financial visibility and increase the risk of late payments or compliance failures.

Traditional AP processes often struggle with:

High invoice volumes and time-consuming data entry

Lack of visibility in invoice status and approval bottlenecks

Missed early payment discounts and duplicate payments

Labor-intensive audits and reconciliations

These inefficiencies not only affect operational performance but also impact vendor relationships and bottom-line profitability.

To counter these issues, many finance teams are implementing accounts payable automation services that enable end-to-end visibility, eliminate manual tasks, and ensure accuracy and compliance with U.S. tax regulations.

What Makes AP Automation Services a Game-Changer?

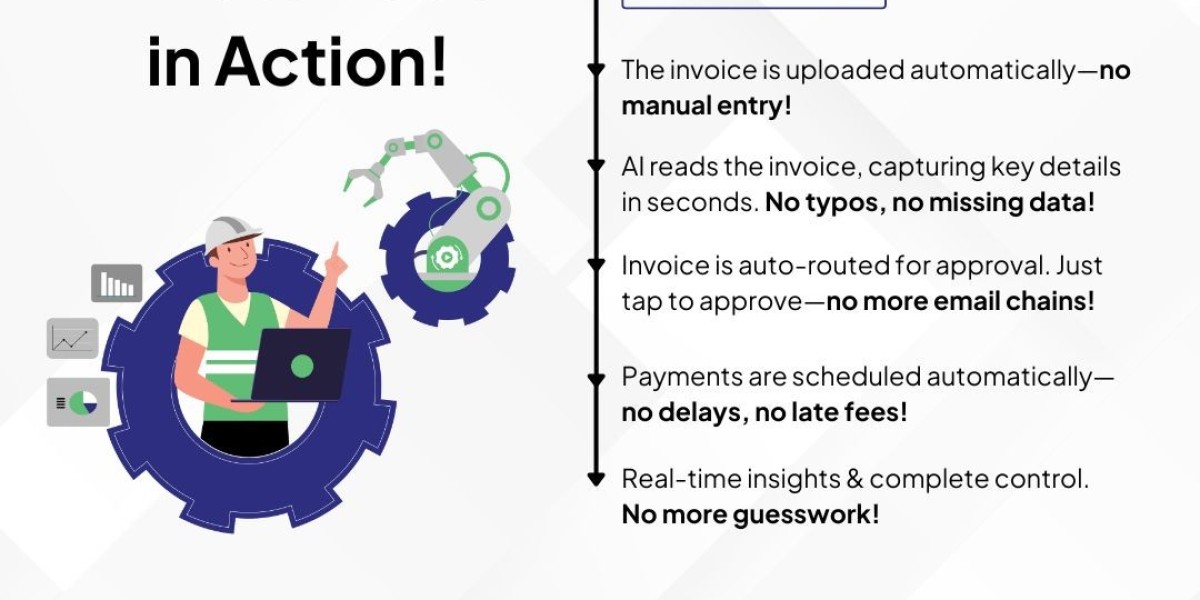

AP automation transforms the accounts payable process from a reactive, error-prone function into a proactive, strategic workflow. With automation, invoices are captured electronically, matched with purchase orders and receipts, and routed automatically through predefined approval chains. The result? Faster processing, greater accuracy, and complete control.

Here’s what you can expect from implementing AP automation services:

1. Faster Invoice Processing

Invoices are captured via OCR and AI-driven tools and entered into your financial system without human input. This cuts down processing time drastically and ensures quicker approval turnaround.

2. Reduced Errors and Fraud Risk

Rule-based automation checks for duplicates, mismatched data, or suspicious entries, reducing the chances of fraud and accounting mistakes.

3. Significant Cost Savings

Automating AP eliminates the costs associated with printing, postage, storage, and manual labor. Studies show that businesses can reduce AP costs by up to 80% through automation.

4. Better Vendor Relationships

By ensuring on-time payments and enabling early payment discounts, businesses can strengthen partnerships and improve negotiation leverage with vendors.

5. Enhanced Compliance and Audit Readiness

Digital records and system-generated logs ensure that your business is always audit-ready and compliant with financial regulations, which is especially crucial in the U.S. regulatory environment.

IBN Technologies: Your Trusted AP Automation Provider in the USA

At IBN Technologies, we combine deep financial expertise with advanced automation technology to provide tailored AP automation services to businesses across various industries in the USA, including manufacturing, retail, healthcare, logistics, and financial services.

Our accounts payable automation solutions include:

Invoice Data Capture: Using OCR and AI tools, we extract relevant data from emailed, scanned, or uploaded invoices.

Workflow Automation: Multi-tiered, rules-based approval routing for different invoice types and values.

ERP Integration: Seamless syncing with systems like SAP, Oracle, NetSuite, QuickBooks, and others.

Cloud-Based Access: Secure, centralized invoice storage with role-based access and audit trails.

Analytics and Reporting: Real-time dashboards that provide insights into processing times, pending approvals, and vendor performance.

What sets IBN apart as a reliable AP automation provider is our ability to customize solutions based on the client’s operational workflow and compliance requirements. We take the time to understand your process and design automation that fits perfectly, rather than forcing you to change your existing system.

Why U.S. Companies Are Embracing AP Automation Now

The business environment in the USA is evolving rapidly. Regulatory requirements are becoming stricter, vendor expectations are increasing, and internal finance teams are under pressure to do more with less. Automation has emerged as the solution to these modern-day challenges.

Here are the reasons companies in the USA are focusing on accounts payable automation services:

Scalability: As businesses grow, manual AP processes can’t keep up. Automation handles scale effortlessly.

Remote and Hybrid Work Models: With geographically dispersed teams, digital approval workflows are essential for uninterrupted operations.

Cash Flow Optimization: Real-time insights into payables help finance teams manage working capital more effectively.

Regulatory Compliance: Automated audit trails and tax-compliant processes ensure businesses are always ready for internal or external audits.

Vendor Expectations: Vendors expect faster, error-free payments. AP automation ensures timely disbursements and enhances supplier trust.

Real Results Delivered by IBN Technologies

Many of our clients in the USA have reported measurable improvements after implementing our accounts payable automation solutions, including:

A 60% reduction in invoice processing time

80% fewer payment errors

40% savings in operational costs

Enhanced team productivity and focus on strategic tasks

We collaborate closely with each client to guarantee seamless implementation, effective change management, and continuous optimization. Our support doesn’t stop after deployment; we continuously refine your AP automation setup to align with evolving business goals.

Conclusion: Automate Your Payables, Elevate Your Business

In today’s digital-first world, relying on manual AP processes puts your business at a disadvantage. By partnering with a proven AP automation provider like IBN Technologies, you can transform your finance operations into a streamlined, strategic powerhouse. Our AP automation services enable U.S.-based companies to reduce costs, increase accuracy, and gain real-time visibility into their financial operations. From capturing invoices to executing payments, we streamline and secure every aspect of the accounts payable workflow. Make the smart move today, digitize your accounts payable with IBN Technologies, and unlock new levels of efficiency and control. Contact us now to learn more about our AP automation solutions tailored for businesses in the USA.