In the world of business transactions, documentation is everything. One such critical document that every seller must know and use is the sales invoice. Whether you're a freelancer, a small business owner, or a growing enterprise, understanding what a sales invoice is and how to create one efficiently can simplify your billing process, ensure timely payments, and keep your finances in order.

In this comprehensive guide, we’ll explore everything about sales invoices — from their definition and components to examples, format, and how you can create one effortlessly using tools like InvoPilot.

What Is a Sales Invoice?

A sales invoice is a document issued by a seller to a buyer that outlines the products or services sold, their quantity, agreed prices, taxes, and total amount payable. It is a formal request for payment and serves as a legal record of a sale.

Unlike quotes or proforma invoices, a sales invoice is sent after the sale has been completed and the goods/services have been delivered. It acts as an essential accounting document for both buyers and sellers.

? Sales invoice documents are crucial for business transactions, tax filing, and cash flow management.

Why Are Sales Invoices Important?

Sales invoices serve multiple purposes:

Payment Collection: It tells your clients exactly how much they owe and when the payment is due.

Record Keeping: Acts as legal proof of a completed transaction for audits and tax filing.

Inventory Tracking: Helps businesses track which goods or services have been delivered.

Cash Flow Monitoring: Enables businesses to manage receivables and forecast income.

Legal Protection: In case of disputes, the invoice serves as written documentation of the sale.

Key Components of a Sales Invoice

To ensure your sales invoice is valid and professional, it should include the following elements:

Header

Business name, logo, and contact details

Title: "Sales Invoice"

Invoice Number

A unique identifier to track the invoice

Date of Issue

The date when the invoice is created

Due Date

When the payment is expected (e.g., Net 15, Net 30)

Buyer’s Information

Client name, company, address, email

Description of Products/Services

Itemized list of goods/services with quantity, rate, and price

Subtotal, Taxes, and Discounts

Break down the cost, tax amount (GST/VAT), and any discounts

Total Amount Payable

The final amount the client owes

Payment Instructions

Bank details, UPI ID, or payment link

Terms and Conditions

Refund policy, late fees, or warranties

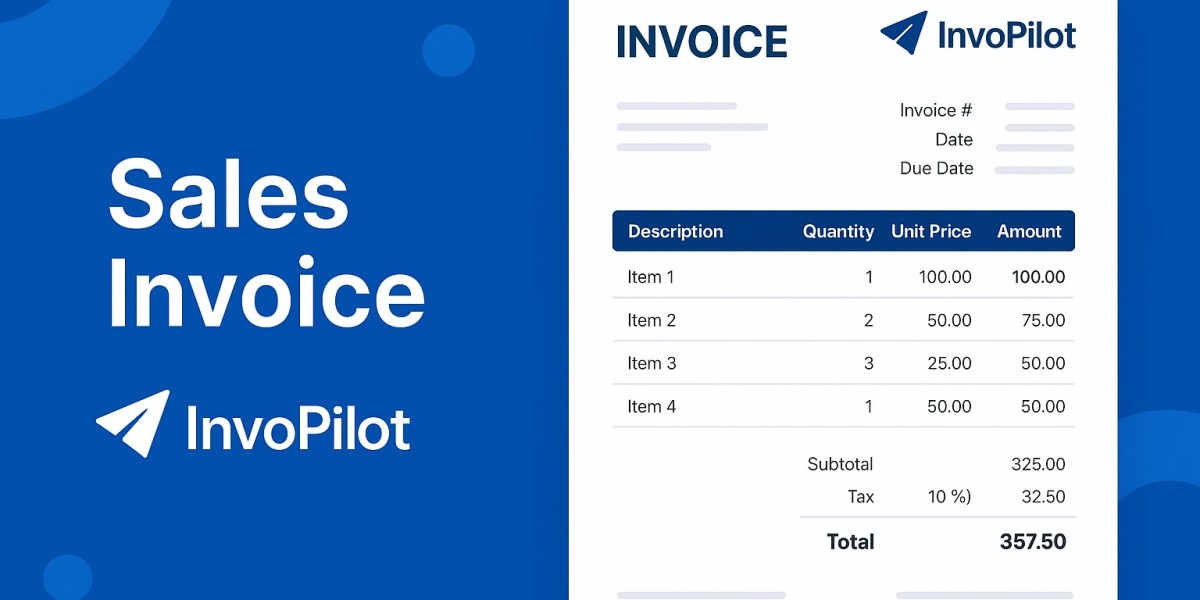

Sales Invoice Format (Sample Template)

Here’s a simple format of a sales invoice:

How to Create a Sales Invoice

You can create a sales invoice manually in Excel or Word, but for speed, accuracy, and professionalism, using an online invoice generator is the smarter way.

Step-by-Step Process:

Select a Template: Use a premade invoice template with all required fields.

Fill in Business and Client Info: Add your company details and the client’s information.

Add Product/Service Details: Itemize what you sold.

Include Taxes & Discounts: Apply applicable GST/VAT and any discounts.

Add Payment Details: Mention where and how the client should pay.

Download or Email the Invoice: Save as PDF or email it directly.

Best Practices for Sending Sales Invoices

To ensure timely payment and maintain professionalism:

Send the invoice immediately after goods are delivered.

Use clear and consistent invoice numbers.

Mention due dates prominently.

Follow up politely after the due date.

Offer multiple payment options for client convenience.

Keep digital and physical records of every invoice sent.

Common Mistakes to Avoid

Missing Key Information: Avoid leaving out details like invoice number, due date, or tax amount.

Poor Formatting: Cluttered or confusing invoices can delay payment.

No Terms & Conditions: Always include payment terms to protect your interests.

Wrong Tax Calculation: Errors in tax computation can affect compliance and trust.

Delayed Invoicing: Send invoices promptly to maintain cash flow.

Sales Invoice vs Tax Invoice vs Proforma Invoice

| Feature | Sales Invoice | Tax Invoice | Proforma Invoice |

|---|---|---|---|

| Purpose | Request payment | Claim tax credit (GST) | Estimated bill before sale |

| Issued When | After sale is completed | After sale | Before sale confirmation |

| Legally Binding? | Yes | Yes | No |

| Includes Tax? | Optional | Yes | Optional |

| Suitable For | Domestic/Export Sales | B2B GST Sales | Quotations, Approvals |

Automate Sales Invoices with InvoPilot

Manual invoicing is tedious, error-prone, and time-consuming. That’s where InvoPilot comes in. InvoPilot is a modern invoicing platform that helps businesses of all sizes generate professional invoices in seconds. Whether you're a freelancer, trader, startup, or large enterprise, InvoPilot gives you the power to:

Create and customize invoices online

Include taxes, discounts, and payment links

Track invoice status and send reminders

Export invoices as PDFs

Save time with reusable templates

And the best part? You can try the free invoice generator today—no signup required.

Real-Life Example of a Sales Invoice

Scenario:

Raj owns a home appliances store. He sells 5 air purifiers to a local hotel chain for ₹25,000 each, with GST @18%.

Here’s what Raj’s sales invoice would look like:

Raj emails this invoice the same day and receives payment within a week.

Final Thoughts

Sales invoices are more than just billing documents—they are the financial backbone of your business operations. A well-structured, timely, and professional invoice not only improves cash flow but also builds credibility with your clients.

By understanding the structure of a sales invoice, its importance, and how to create one efficiently using tools like InvoPilot, you're setting your business up for smoother operations and better financial tracking.

Whether you’re sending one invoice a month or a hundred a day, automating the process with a reliable tool can make all the difference. Don't wait—start using a free invoice generator today and take control of your billing with ease.

FAQs About Sales Invoices

Q1. Is a sales invoice legally required?

Yes, in most jurisdictions, sales invoices are required for tax and audit purposes, especially for B2B transactions.

Q2. Can I use Excel to make sales invoices?

Yes, but online tools offer better automation, formatting, and tracking.

Q3. What’s the difference between an invoice and a bill?

An invoice is typically issued by a seller; a bill is seen from the buyer’s perspective.

Q4. Should I include tax in every invoice?

Only if your business is registered for GST/VAT or any local tax law requires it.