For IT firms in the United States, efficiency and scalability are more than business goals—they are survival strategies. From managing vendor invoices to paying cloud service providers, financial operations play a big role in keeping projects on track. Yet, many technology firms struggle with one critical back-office task: accounts payable (AP). That’s why a growing number of businesses now choose to outsource accounts payable services for IT industry requirements. But what does this really mean for IT companies, and how do you decide if outsourcing is the right move? Let’s break it down.

Why Accounts Payable Matters in the IT Industry

IT firms deal with unique challenges that make AP more complex than in other industries. Consider this:

Multiple software subscriptions and SaaS renewals every month.

Global vendor payments for offshore developers and hardware providers.

Frequent project-based expenses that need accurate tracking.

Compliance requirements with U.S. tax and financial reporting standards.

With so many moving parts, even a small mistake—like a delayed payment or missed invoice—can disrupt projects, damage vendor relationships, and impact cash flow. This is why outsourcing has become a preferred solution.

What Does It Mean to Outsource Accounts Payable Services?

Outsourcing accounts payable means partnering with a specialized service provider to manage tasks such as:

Receiving, validating, and processing invoices.

Matching invoices to purchase orders and contracts.

Scheduling vendor payments.

Tracking expenses by project or client.

Preparing compliance-ready reports.

For IT firms, outsourcing ensures AP is handled by professionals who understand the nuances of technology-driven businesses, while freeing up internal teams to focus on client solutions and innovation.

Why US IT Firms Should Consider Outsourcing AP

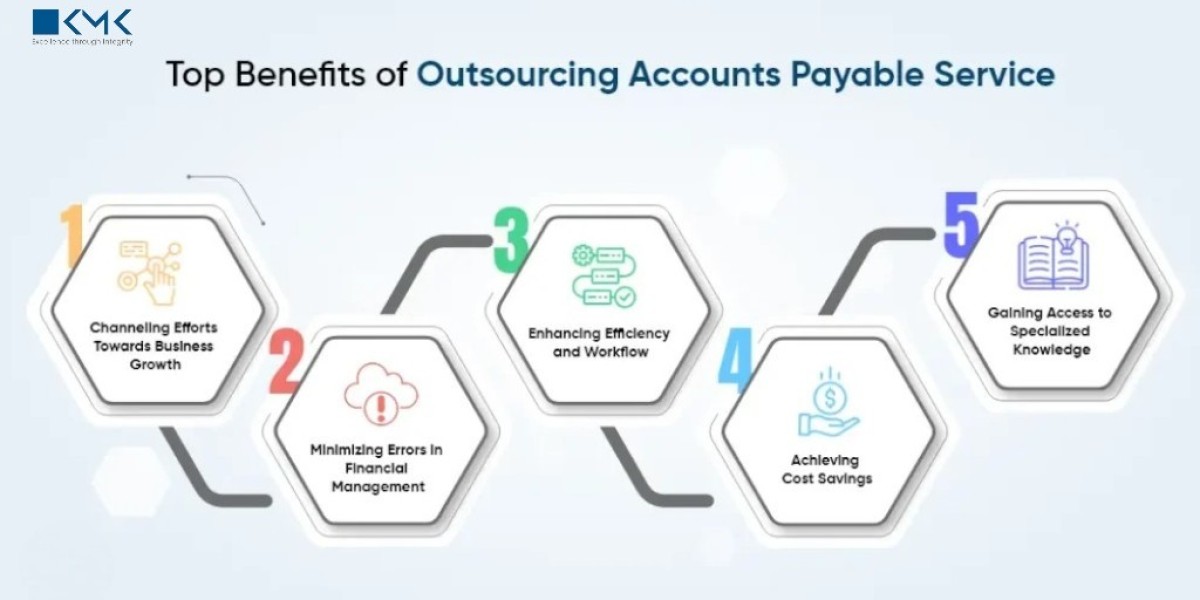

So, why is it smart to outsource accounts payable services for IT industry workflows? Here are some compelling reasons:

1. Efficiency Gains Through Automation

Outsourcing providers use cloud-based AP automation tools that capture invoices digitally, eliminate manual data entry, and speed up approvals. This means fewer errors, faster payments, and better visibility.

2. Cost Savings

Building an in-house AP team can be expensive. Outsourcing allows IT firms to save on hiring, training, and software costs while still benefiting from expert service.

3. Scalability as You Grow

Whether you’re a startup adding new clients or a larger firm expanding globally, outsourcing AP ensures your financial operations can scale without disruption.

4. Stronger Compliance and Security

Reputable providers follow strict compliance measures such as SOC 2 standards and use advanced security protocols to protect sensitive vendor and financial data.

5. Better Vendor Relationships

Timely, accurate payments strengthen trust with vendors and partners—critical in the IT space where collaborations are global and deadlines are tight.

How the Outsourcing Process Works

For IT firms new to outsourcing, here’s what a typical accounts payable workflow looks like:

Invoice Capture – Vendors send invoices to the outsourcing team via a secure platform.

Validation – Invoices are verified against purchase orders and contract terms.

Approval Routing – Managers at your IT firm approve invoices digitally.

Payment Execution – Vendors are paid accurately and on time.

Reporting and Compliance – Monthly reports provide insights into cash flow and audit readiness.

This structured approach eliminates bottlenecks and ensures accountability at every step.

Key Factors to Consider Before Outsourcing

Outsourcing AP can be highly beneficial, but IT firms should carefully evaluate providers. Ask these questions:

Do they have experience working with IT firms and subscription-based billing?

Can they integrate with your existing ERP or accounting software (QuickBooks, NetSuite, SAP)?

What data security measures are in place?

Do they offer real-time dashboards for visibility?

Can they handle both domestic and international vendor payments?

Choosing the right partner ensures you get the efficiency and scalability you’re looking for.

Benefits That Go Beyond Cost Savings

While saving money is a big draw, outsourcing accounts payable offers additional long-term benefits for IT firms:

Improved cash flow visibility for smarter financial planning.

Reduced risk of errors and fraud thanks to secure, automated systems.

Faster turnaround times for invoice processing.

Freedom for your team to focus on client projects, R&D, and growth strategies.

Stronger competitive edge by aligning financial operations with business goals.

For IT firms competing in a global market, these benefits create a clear path to sustainable success.

Addressing Common Concerns About Outsourcing

IT leaders often hesitate because of myths or misconceptions about outsourcing. Let’s address a few:

“We’ll lose control of payments.”

In reality, you remain in charge of approvals while the provider manages execution.“What about data security?”

Trusted providers use encryption, firewalls, and compliance protocols to safeguard sensitive financial information.“Will it integrate with our systems?”

Most outsourcing firms specialize in seamless integration with ERP and accounting software.“What if they’re offshore?”

Many providers offer overlapping U.S. business hours and dedicated support teams.

When handled strategically, outsourcing actually increases control and transparency.

Is Outsourcing Right for Your IT Firm?

Here are a few signs that it may be time for your business to outsource accounts payable services for IT industry workflows:

Your team is overwhelmed by manual invoice processing.

Vendor payments are delayed, causing strained relationships.

You’re expanding and need scalable financial processes.

Compliance audits are stressful and time-consuming.

You want real-time visibility into AP data without heavy investment in new software.

If any of these sound familiar, outsourcing could be the right step forward.

Final Thoughts

For U.S.-based IT firms, outsourcing accounts payable is more than a cost-cutting measure—it’s a strategy for efficiency, scalability, and growth. By leveraging expert partners and automation technology, IT companies can ensure their financial operations run smoothly while focusing on what they do best: delivering innovation. In an industry where every second counts, choosing to outsource accounts payable services for IT industry needs may be the smartest move your IT firm makes this year.