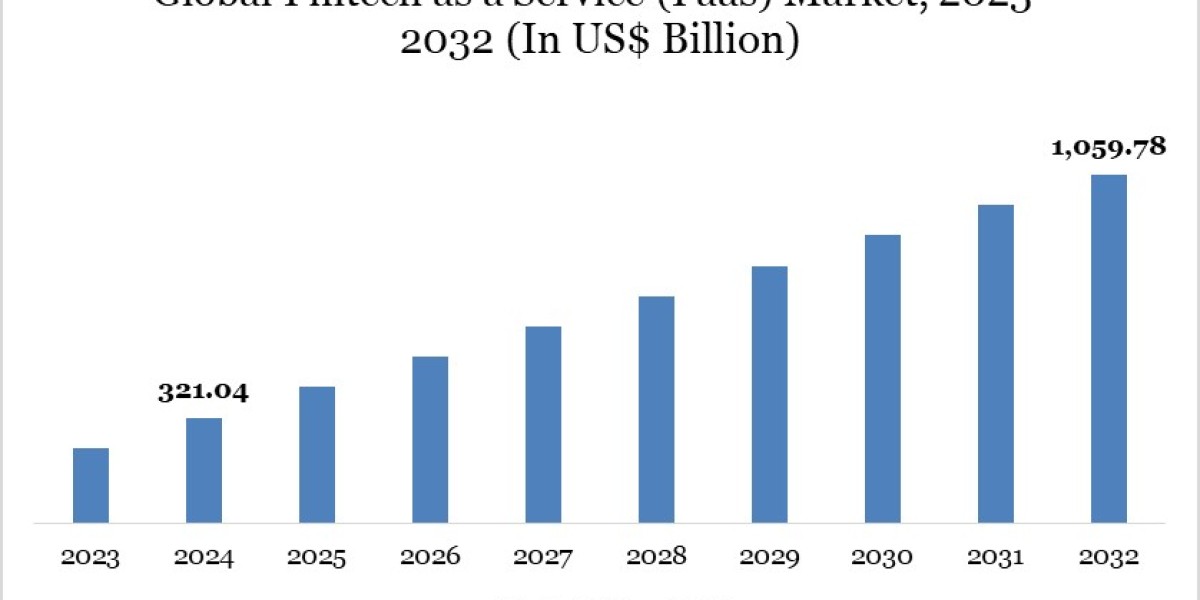

The Fintech as a Service Market landscape is undergoing a transformative shift, driven by rapid technological advancements, evolving consumer behaviors, and intensifying competition across industries. This comprehensive market research report delivers in-depth insights, growth projections, and strategic analysis across key segments, empowering stakeholders with data-driven intelligence. Leveraging advanced analytics, trend forecasting, and competitive benchmarking, the report uncovers critical developments in innovation, emerging technologies, supply chain dynamics, and regulatory frameworks. Whether you're exploring investment opportunities, product development strategies, or expansion into high-growth regions, this report serves as your essential guide to navigating today’s dynamic market environment.

Fintech as a Service Market Report by DataM Intelligence offers a detailed assessment of the global fintech and digital financial infrastructure landscape, highlighting market size, key players, and critical growth drivers. With the rise of embedded finance, open APIs, and AI-powered platforms, the report delivers strategic insights from 2025 to 2033. In 2025, fintech adoption surged alongside generative AI integration, enhancing customer experience and operational efficiency. Major U.S. financial institutions invested heavily in digital infrastructure and began implementing new data-access models that may reshape partnerships with fintech providers.

Get exclusive insights with our detailed free sample report (Corporate Email ID gets priority access): https://www.datamintelligence.com/download-sample/fintech-as-a-service-market?freehp

Fintech as a Service Market Segments

By Type (Payments as a Service, Banking as a Service (BaaS), Lending as a Service, Insurance as a Service (InsurTech), Others), By Deployment (Cloud-Based, On-Premises, Hybrid), By Technology (API-based Services, Blockchain, AI & Machine Learning, Robotic Process Automation (RPA), Others), By Application (Banks & Financial Institutions, Insurance Companies, Fintech Startups, eCommerce & Retail Businesses, Telecom Companies, Government Agencies, Others)

Fintech as a Service Market Dynamics

The fintech as a service market is expanding rapidly due to the rising demand for digital banking, mobile payments, and embedded finance solutions across industries. Drivers include increasing adoption of APIs and cloud-based services, the need for faster financial transactions, and regulatory support for open banking. Small and medium-sized enterprises (SMEs) are increasingly leveraging FaaS platforms to reduce costs and improve customer experience, further accelerating market growth.

Major Players Shaping the Competitive Landscape:

Finastra, Stripe, Inc, Rapyd Financial Network Ltd, foo.mobi, Solid Financial Technologies, Inc, Synctera Inc, SAP Fioneer, TCS BaNCS, PayMate, Backbase and among others.

Important Mergers, Acquisitions, and Market Shifts:

➠ In 2024, Global financial technology leader FIS had launch of its 2024 FIS Fintech Hangout Series, an initiative that fosters and connects fintech startups, investors, financial institutions, FIS experts, and participants from the FIS Fintech Accelerator Program.

➠ Stripe, a leading FaaS provider, powers embedded payment infrastructure for platforms like Shopify and Amazon, enabling seamless transactions across geographies. The market is expanding across regions, with fintech-friendly regulations in the EU, India, and the US fostering innovation. As both startups and large enterprises increasingly look for cost-effective, scalable, and secure fintech solutions, the FaaS model is becoming a foundational pillar in the evolving digital finance ecosystem.

Methodology and Scope:

This Fintech as a Service Market report is developed using a robust research methodology that combines primary interviews, insights from industry experts, and verified secondary sources such as company filings, trade journals, and trusted databases. It follows a bottom-up and top-down approach to ensure data accuracy through triangulation. The scope of the report covers current market trends, growth potential, and strategic developments across global and regional markets.

Regional Overview for Fintech as a Service Market:

⇥ North America (U.S., Canada, Mexico)

⇥ Europe (U.K., Italy, Germany, Russia, France, Spain, The Netherlands and Rest of Europe)

⇥ Asia-Pacific (India, Japan, China, South Korea, Australia, Indonesia Rest of Asia Pacific)

⇥ South America (Colombia, Brazil, Argentina, Rest of South America)

⇥ Middle East & Africa (Saudi Arabia, U.A.E., South Africa, Rest of Middle East & Africa)

The Report Includes:

➡ A descriptive analysis of demand-supply gap, market size estimation, SWOT analysis, PESTEL Analysis and forecast in the global market.

➡ Go-to-market Strategy.

➡ Neutral perspective on the market performance.

➡ Customized regional/country reports as per request and country level analysis.

➡ Potential & niche segments and regions exhibiting promising growth covered.

People Also Ask:

➠ What are the global sales, production, consumption, imports, and exports in the Fintech as a Service market?

➠ Who are the top manufacturers, and what are their capacity, production, sales, pricing, and revenue stats?

➠ What key opportunities and challenges do vendors face in the Fintech as a Service industry?

➠ Which product types, applications, or end-users are driving market growth, and what is their market share?

➠ What are the major growth drivers and restraints of the Fintech as a Service market?

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com