Entering the world of forex trading can feel overwhelming, especially for beginners grappling with the complexities of the market. A fundamental component of successful trading is understanding how to manage risk, which largely hinges on proper position sizing. This is where a lot size calculator becomes an invaluable tool. It simplifies the process of determining the right amount of currency to trade, making it easier for novice traders to engage in forex markets with confidence. This article explores how a lot size calculator can help beginners streamline their forex position sizing and cultivate effective trading habits.

What is Lot Size in Forex?

In forex trading, lot size refers to the number of units of currency that are traded in a single transaction. It plays a crucial role in determining the potential profit or loss from a trade. Forex markets typically use three primary types of lots: standard lots (100,000 units), mini lots (10,000 units), and micro lots (1,000 units). For beginners, mastering the concepts of lot size is essential because it impacts the amount of money at stake in each trade. Accurate calculations help traders avoid over-leveraging and ensure that they only risk a manageable portion of their capital on any single trade.

The Significance of Position Sizing

Position sizing is the process of determining how much capital to allocate to a specific trading position. For beginners, understanding position sizing is vital for effective risk management. It helps establish boundaries on how much of their total capital should be risked on an individual trade, typically recommended to be between 1-3% of the account balance. By defining their risk exposure, beginners can prevent significant losses that could jeopardize their trading accounts. Position sizing, when paired with a lot size calculator, enables aspiring traders to develop a methodical approach to trading, fostering discipline in their strategies.

How Does a Lot Size Calculator Work?

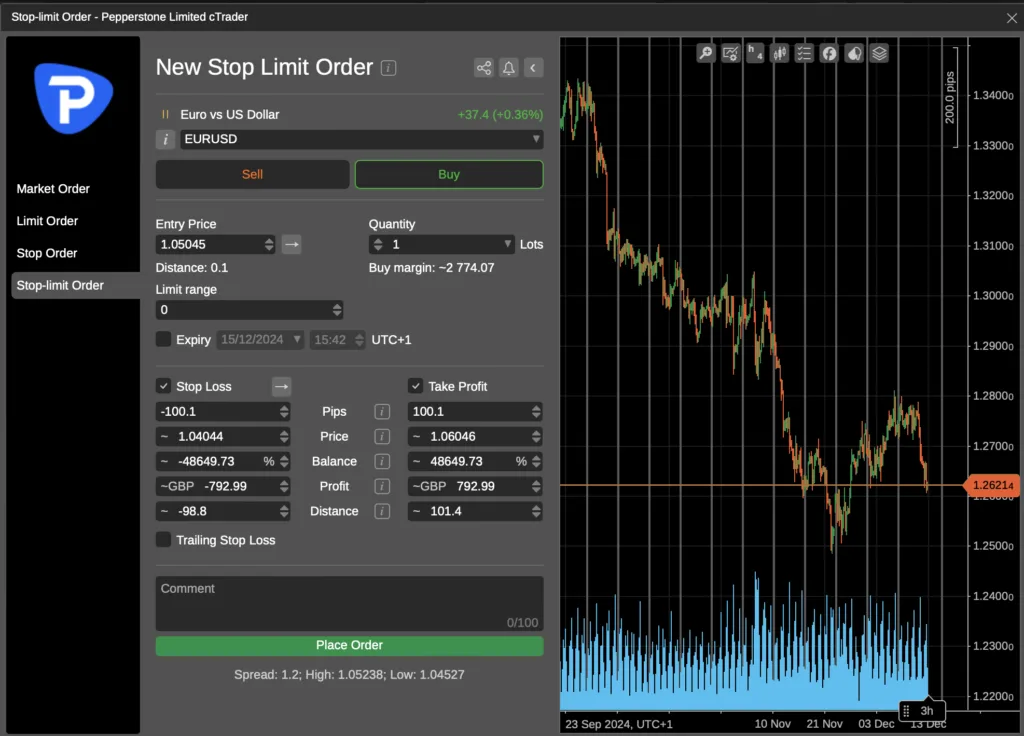

A lot size calculator is a user-friendly tool designed to simplify the calculation of position sizes based on specific inputs. To use the calculator, traders typically need to provide essential details such as their account balance, risk percentage per trade, entry price, and stop-loss level. Based on this information, the calculator instantly computes the optimal lot size for a trade, helping traders manage their risk effectively. This automation and instant feedback remove the complexities associated with manual calculations, allowing beginners to focus on market analysis and strategy rather than the math involved in trading.

Steps to Using a Lot Size Calculator

For beginners, using a lot size calculator is straightforward and beneficial. The first step involves determining the account balance and how much of that balance they are willing to risk on a single trade. For instance, if a trader has an account balance of $5,000 and decides to risk 2%, they should cap their risk at $100. Next, they need to set an entry price for the currency pair they wish to trade and define a stop-loss level to indicate where they would exit the trade if it moves against them. By entering this data into the lot size calculator, they will receive a recommended lot size, facilitating informed and responsible trading decisions.

Advantages of Using a Lot Size Calculator

The primary advantage of using a lot size calculator for beginners lies in its ability to enhance risk management while promoting consistency in trading practices. New traders often struggle with emotions that can influence their decisions, leading to impulsive trading behaviors. By relying on a calculator to determine the appropriate lot size, beginners can cultivate a disciplined approach, making trading decisions based on data rather than emotions. Furthermore, the calculator’s ability to quickly perform calculations instills confidence in traders, enabling them to focus on developing their trading strategies without the distraction of intricate calculations.

Building a Strong Foundation for Future Trading

For beginners, developing a solid foundation in trading principles is crucial for long-term success. Using a lot size calculator contributes to this foundation by reinforcing the importance of risk management from the outset. As new traders learn to calculate lot sizes accurately, they become more aware of their risk exposure and its implications on their overall trading performance. This understanding fosters a gradual evolution toward more advanced trading strategies as traders gain experience and confidence. A strong grasp of position sizing will serve beginners well as they navigate the ever-changing landscape of the forex market.

Conclusion: Empowering Beginners in Forex Trading

In conclusion, the lot size calculator is an indispensable tool that simplifies the complexities of forex position sizing for beginners. By providing an easy-to-use platform for calculating optimal lot sizes, it enables novice traders to manage risk effectively and develop disciplined trading habits. Understanding the significance of position sizing empowers beginners to make informed decisions, setting the stage for their future success in forex trading. As they gain experience and knowledge, the tools and strategies established in the early stages will serve as a critical foundation for navigating the intricacies of the forex market with confidence and competence. Embracing tools like the lot size calculator not only enhances traders' abilities but also strengthens their overall trading journey.