In the fast-paced world of forex trading, managing risk effectively is a critical competency for traders aiming for long-term success. One tool that plays a vital role in this process is the lot size calculator. This calculator aids traders in determining the appropriate size of their position based on specific risk parameters and account balances. By facilitating accurate calculations, it helps traders align their trading strategies with their risk management goals. This article delves into the importance of a lot size calculator in achieving effective forex position sizing, exploring how it empowers traders to make informed decisions.

Understanding Forex Position Sizing

Position sizing is the process of determining how much capital to allocate to a specific trade. It is a fundamental element of risk management in forex trading, as it directly affects potential profits and losses. The right position size allows traders to manage their risks effectively while still capitalizing on opportunities for profit. In forex, correct position sizing ensures that traders do not risk more than they can afford to lose and helps maintain a healthy balance within their trading accounts. Without effective position sizing, traders may find themselves over-leveraged, leading to significant losses that can quickly deplete their trading capital.

The Importance of Risk Management

Risk management is the backbone of successful trading strategies. It involves identifying potential risks, assessing their impacts, and implementing measures to mitigate them. In forex trading, volatility can be high, leading to rapid price fluctuations that can result in large gains or losses. A solid risk management plan, which includes effective position sizing, protects traders from catastrophic losses. A lot size calculator assists traders in defining their acceptable level of risk based on their overall account balance and personal risk tolerance, which is essential for maintaining discipline in trading practices.

How a Lot Size Calculator Works

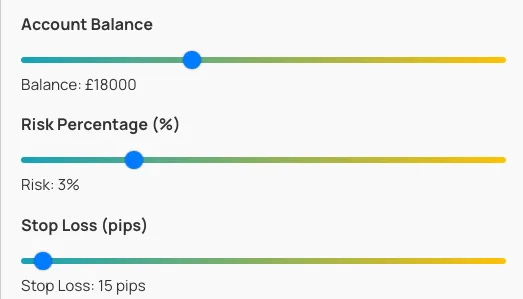

A lot size calculator simplifies the process of determining how much capital to allocate to each trade. Traders typically input several key data points, including their account balance, the percentage of their capital they are willing to risk on a single trade, the entry price, and the stop-loss distance. Based on these inputs, the calculator computes the optimal lot size, providing traders with a clear guideline on how many lots to trade. This not only saves time but also significantly reduces the possibility of human error in calculations, fostering more reliable trading decisions.

Benefits of Using a Lot Size Calculator

Using a lot size calculator comes with numerous benefits, particularly in enhancing a trader's overall strategy. One of the primary advantages is that it instills discipline in trading. By calculating the right position size, traders can adhere to their defined risk parameters, avoiding the temptation to over-leverage or take hasty decisions based on emotions. Furthermore, lot size calculators allow traders to simulate different scenarios, enabling them to test their strategies under various market conditions. This practice enhances their preparedness for unpredictable market movements and equips them with the confidence needed to execute trades effectively.

Supporting Consistency Across Trading Sessions

For traders, consistency is a key component of success. A lot size calculator helps foster this consistency by enabling traders to apply a systematic approach to their trades. Instead of relying on intuition or guesswork, traders can use the calculator to define their position sizes based on tangible data. This structured approach not only enhances decision-making clarity but also allows traders to evaluate their performance meticulously over time. By maintaining consistency in their risk management practices, traders can streamline their trading processes and enhance their overall profitability.

Integrating a Lot Size Calculator into Your Trading Strategy

To maximize the benefits of a lot size calculator, traders should integrate it seamlessly into their trading strategies. This involves using the calculator before entering a trade to confirm that the position size aligns with their risk management plan. Additionally, traders should periodically review their account balances and adjust their risk parameters accordingly, ensuring that their calculations remain relevant to their evolving market circumstances. By incorporating the lot size calculator into their routine, traders can develop a more disciplined, data-driven approach, ultimately promoting a culture of continual improvement in their trading activities.

Conclusion: The Path to Informed Trading Decisions

In conclusion, the lot size calculator plays a crucial role in achieving effective forex position sizing. It serves as a reliable tool that simplifies the complex calculations related to trade sizes, empowering traders to make informed decisions while managing risk effectively. Through accurate position sizing, traders can safeguard their capital and enhance their trading strategies, fostering a disciplined approach that can lead to long-term success. As the forex market continues to evolve, adopting tools such as the lot size calculator will remain essential for traders seeking to navigate its complexities with confidence and clarity. Ultimately, incorporating this tool in daily trading practices lays the groundwork for a more sustainable and profitable trading journey.