Financial Challenges in the Hospitality Industry

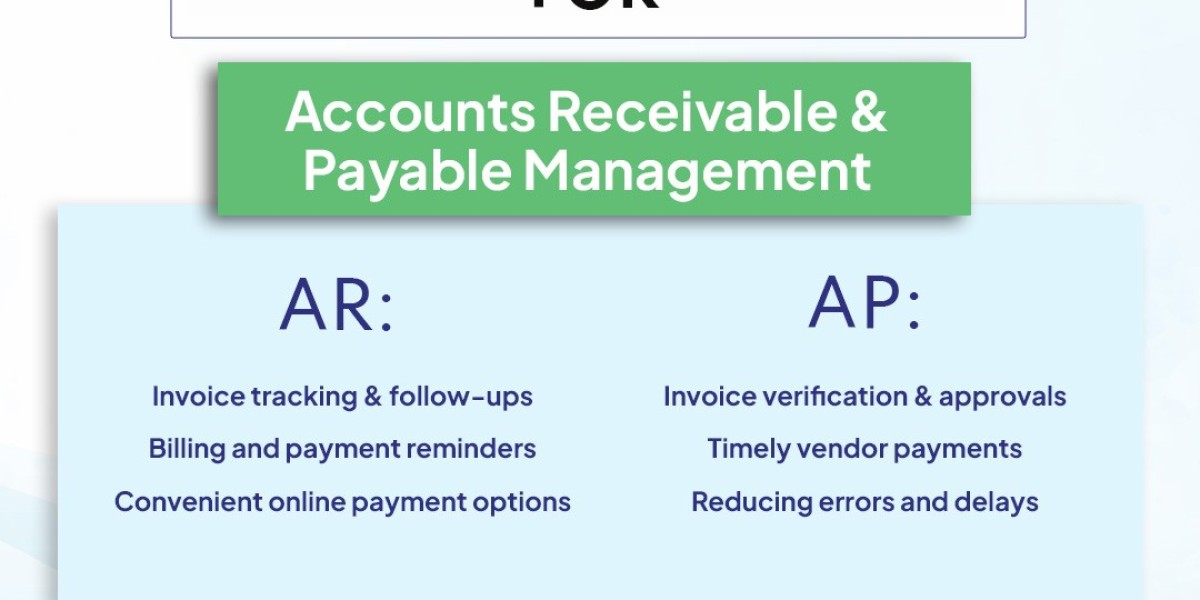

Hospitality businesses in the United States—hotels, resorts, and restaurants—deal with numerous financial transactions every day. From vendor invoices and contractor payments to guest payments and operational expenses, managing all these can be overwhelming.

Delays in payments or errors in bookkeeping can disrupt operations, affecting service quality and profitability. This is why many hospitality businesses are turning to outsourcing accounts payable and receivable.

Benefits of Outsourcing Accounts Payable and Receivable

By outsourcing both payables and receivables, hospitality businesses can:

Ensure Timely Payments: Contractors, suppliers, and vendors are paid on time, maintaining strong business relationships.

Improve Accuracy: Reduce errors in invoices, payroll, and reconciliations.

Enhance Cash Flow Management: Streamline both incoming and outgoing payments.

Allow Focus on Core Operations: Staff can dedicate more time to guest experience rather than financial processes.

Outsourcing creates a structured financial system that keeps operations running smoothly.

Role of Construction Account Payable Service

For hospitality businesses involved in renovations, expansions, or property construction, construction account payable service is essential. These services help manage large contractor invoices, material supplier bills, and project-based payments efficiently.

Benefits include:

Streamlined invoice processing for construction projects.

Timely payments to contractors to avoid project delays.

Clear documentation for audits and compliance.

Improved budget tracking for construction and renovation projects.

This ensures construction projects stay on schedule and within budget while maintaining financial accuracy.

Working with Accounts Receivable Outsourcing Companies

On the receivables side, collaborating with accounts receivable outsourcing companies allows hospitality businesses to:

Track guest and corporate client payments efficiently.

Reduce overdue invoices and improve collections.

Access detailed reports to analyze cash flow and revenue patterns.

Maintain liquidity to fund daily operations and expansion projects.

These companies specialize in improving collections, giving hospitality firms predictable cash flow and financial stability.

About IBN Technologies

IBN Technologies has over 20 years of experience providing financial outsourcing solutions in the United States. Their expertise in outsourcing accounts payable and receivable helps hospitality businesses manage vendor payments and client collections efficiently.

IBN also offers construction account payable service and partners with businesses to deliver robust accounts receivable management, acting as one of the trusted accounts receivable outsourcing companies.

With IBN, hospitality businesses can focus on delivering excellent guest experiences while experts handle their financial operations.

Conclusion

Managing payables and receivables in the hospitality industry is complex, especially with construction projects, multiple properties, and high transaction volumes. By leveraging outsourcing accounts payable and receivable, along with construction account payable service and expert accounts receivable outsourcing companies, US hospitality businesses can improve cash flow, reduce errors, and focus on growth.

Outsourcing is not just about efficiency—it’s a strategy to ensure long-term financial stability and operational success.