Fintech startups trend analysis are revolutionizing the financial services landscape, creating new opportunities for consumers and businesses alike. The rise of technologies such as AI, blockchain, and embedded finance, coupled with a growing investment appetite, is propelling the sector forward. While challenges related to regulatory compliance and cybersecurity remain, the fintech ecosystem is poised for continued growth.

Buy Full Report for More Trend Insights into FinTech Download A Free Report Sample

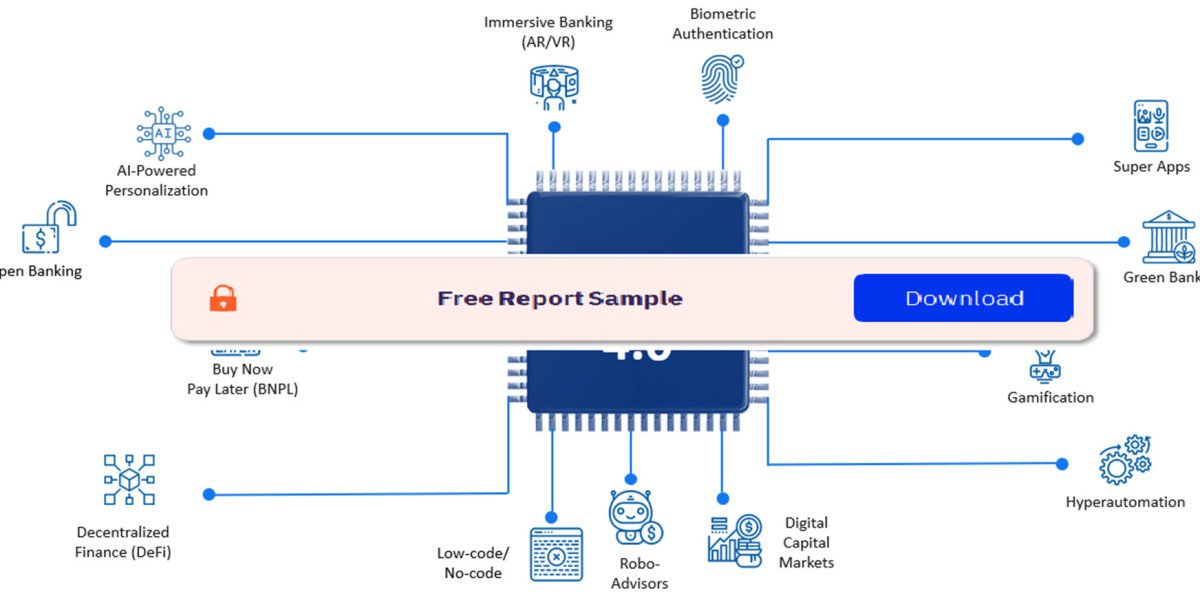

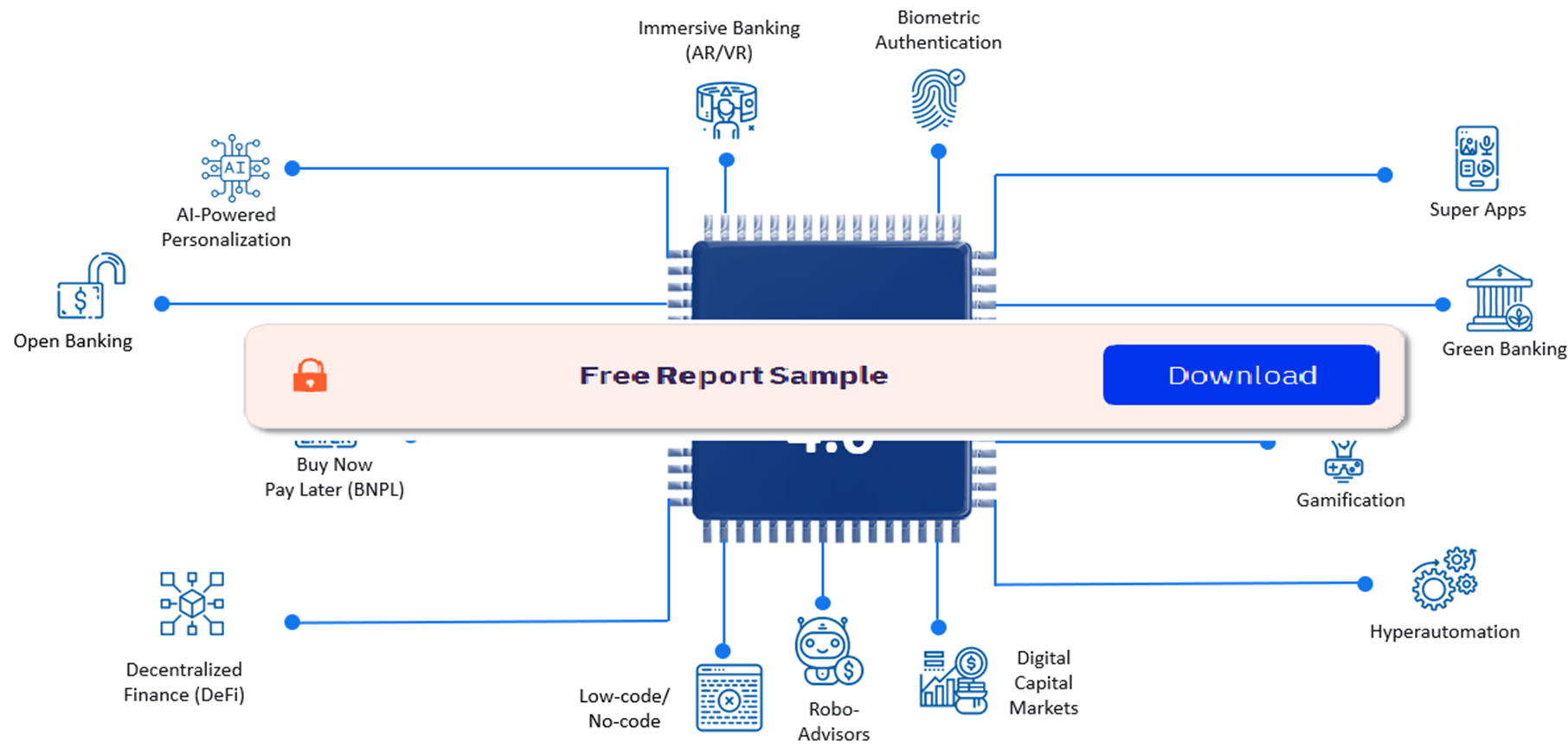

Key Fintech Startups Trends to Watch

Several key trends are shaping the future of fintech startups. These trends encompass new technologies, consumer preferences, and evolving regulatory landscapes.

a. Rise of Embedded Finance

Embedded finance refers to the integration of financial services directly into non-financial products or platforms. Instead of relying on traditional financial institutions, consumers can access services like payments, lending, and insurance within the apps they already use. For example, ride-sharing apps may offer insurance or micro-lending services to their users.

For fintech startups, embedded finance offers a massive opportunity to expand their user base by tapping into ecosystems outside of traditional financial platforms. This trend is also transforming the business model of many startups, making financial services more seamlessly integrated into everyday activities.

- Example: Square offers point-of-sale (POS) systems for businesses, enabling them to accept payments, access loans, and manage their finances—all from the same platform.

b. Artificial Intelligence (AI) and Machine Learning

AI and machine learning (ML) are two of the most disruptive technologies in the fintech sector. These technologies are being used to optimize processes, predict customer behavior, and enhance decision-making. For instance, AI-driven credit scoring models are enabling lenders to offer loans to underbanked populations by using alternative data sources, such as mobile phone usage and social media activity.

Additionally, AI is being employed for fraud detection and risk management, improving the accuracy of financial transactions and ensuring a higher level of security for consumers and businesses.

- Example: ZestFinance uses AI algorithms to assess the creditworthiness of individuals who lack traditional credit histories, thereby helping more people access loans.

c. Blockchain and Cryptocurrencies

Blockchain technology, the foundation of cryptocurrencies like Bitcoin and Ethereum, is gaining widespread adoption within the fintech startup ecosystem. Its decentralized nature offers several advantages, including transparency, reduced transaction costs, and increased security. Many fintech startups are exploring how blockchain can be applied beyond cryptocurrencies, such as for cross-border payments, supply chain management, and smart contracts.

The cryptocurrency market continues to be volatile, but startups in the blockchain space are creating new business models and financial products. Decentralized finance (DeFi) is a key area of innovation, allowing individuals to access financial services like lending, borrowing, and trading without the need for traditional intermediaries.

- Example: Ripple is a blockchain-based payment platform designed to facilitate fast and low-cost cross-border payments.

d. Neo-Banking and Digital Wallets

Neo-banks, also known as digital-only banks, are financial institutions that operate exclusively online, offering services such as savings accounts, loans, and payments without physical branches. These banks are gaining traction due to their low overhead costs, faster services, and more flexible offerings compared to traditional banks.

Digital wallets, such as PayPal, Venmo, and Apple Pay, are also rapidly becoming the preferred method of payment for consumers. These wallets enable users to store and manage multiple payment methods, such as credit cards, debit cards, and bank accounts, on a single platform, enhancing convenience and accessibility.

- Example: Chime is a leading neo-bank offering no-fee accounts and financial tools such as automatic savings and cashback rewards.

e. Personal Finance and Wealth Management

Another significant trend is the rise of fintech startups in the personal finance and wealth management space. With increasing financial literacy and a desire for greater control over their financial futures, consumers are seeking out platforms that offer budgeting tools, investment options, and retirement planning services.

Robo-advisors are a popular solution, leveraging AI to provide automated, low-cost investment management. Additionally, investment platforms are simplifying access to stocks, bonds, and other financial assets, enabling everyday consumers to participate in wealth-building activities that were once exclusive to high-net-worth individuals.

- Example: Betterment is a robo-advisor that offers automated portfolio management and financial advice to help users achieve their long-term financial goals.

f. Open Banking and APIs

Open banking is a system in which banks provide third-party providers with access to customer financial data through APIs (application programming interfaces). This trend is empowering fintech startups to create new financial products and services that can be integrated with existing banking infrastructure. Open banking encourages innovation, fosters competition, and provides consumers with more choice and flexibility.

Through open banking, fintech startups can develop solutions that aggregate financial data from multiple institutions, enable better lending decisions, and offer personalized recommendations to customers.

- Example: Plaid is an API-based fintech company that connects consumer bank accounts to other financial services, such as lending, payments, and personal finance management.