In today’s fast-paced business environment, financial management plays a critical role in driving growth, ensuring compliance, and maintaining operational efficiency. As organizations face increasing complexities in accounting and reporting, traditional bookkeeping methods often fall short in delivering real-time insights, accuracy, and scalability.

But how exactly can SAP bookkeeping services revolutionize your financial management? Let’s explore the benefits and capabilities in detail.

What Are SAP Bookkeeping Services?

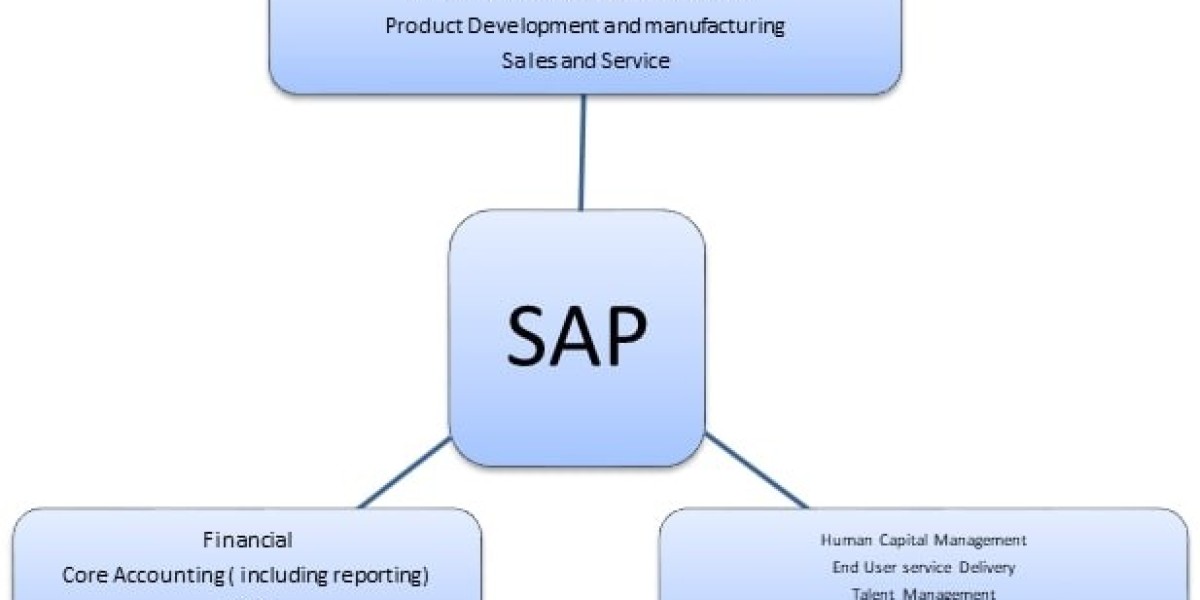

SAP bookkeeping services leverage SAP’s enterprise resource planning (ERP) systems—such as SAP S/4HANA—to automate and streamline financial record-keeping, reporting, and analysis. These services integrate various accounting processes into a unified platform, connecting financial data with other business functions like procurement, sales, inventory, and payroll.

Unlike standalone bookkeeping tools, SAP’s solutions are designed for large-scale, complex organizations that demand real-time data accuracy, compliance with global accounting standards, and advanced analytics capabilities.

Real-Time Financial Insights for Agile Decision-Making

One of the biggest challenges for CFOs and finance teams is accessing up-to-date, reliable financial information to make informed decisions. SAP bookkeeping services offer real-time data processing and reporting, enabling businesses to monitor cash flow, expenses, and revenues as they happen.

This immediate visibility empowers financial leaders to respond quickly to changing market conditions, optimize budgets, and forecast future performance with higher accuracy. Instead of waiting for end-of-month reports, finance teams gain the agility to identify issues or opportunities early and adjust strategies accordingly.

Enhanced Accuracy and Reduced Errors

Manual bookkeeping and fragmented accounting systems are prone to human error, leading to costly mistakes in financial reports or compliance filings. SAP bookkeeping services automate data entry, validation, and reconciliation processes, significantly reducing the risk of errors.

By integrating financial data across departments and automating routine tasks, SAP ensures consistency and accuracy throughout the bookkeeping cycle. This not only minimizes audit risks but also boosts stakeholder confidence in financial statements, a crucial factor for investors, regulators, and business partners.

Scalability and Flexibility to Support Growth

As businesses grow and expand into new markets or product lines, bookkeeping requirements become more complex. SAP bookkeeping services are highly scalable, designed to accommodate growing transaction volumes and diverse accounting needs.

Whether your company operates domestically or internationally, SAP supports multiple currencies, tax regulations, and accounting standards, making it easier to consolidate financials across subsidiaries and regions. This flexibility ensures your bookkeeping processes evolve alongside your business without the need for disruptive system changes.

Streamlined Compliance and Risk Management

Compliance with financial regulations is a non-negotiable aspect of effective bookkeeping. SAP bookkeeping services help businesses stay compliant by automatically incorporating local tax laws, reporting requirements, and audit trails into the bookkeeping process.

The system generates standardized financial reports that comply with accounting standards such as GAAP, IFRS, or others relevant to your industry and location. Additionally, SAP’s advanced security features safeguard sensitive financial data, reducing the risk of fraud and unauthorized access.

Integration with Other Business Functions

One of SAP’s biggest strengths is its ability to integrate bookkeeping with other critical business functions like procurement, inventory management, and sales. This interconnectedness provides a holistic view of your organization’s financial health and operational performance.

For example, when a purchase order is approved, SAP bookkeeping services automatically update the accounts payable ledger, track the transaction against budgets, and reflect the impact on cash flow. This seamless flow of information eliminates duplicate data entry, speeds up processing times, and improves overall financial accuracy.

Advanced Analytics and Predictive Insights

Beyond basic bookkeeping, SAP offers advanced analytics tools that leverage artificial intelligence (AI) and machine learning to provide predictive insights. Finance teams can analyze trends, identify cost-saving opportunities, and forecast future financial scenarios with greater confidence.

These insights help organizations proactively manage risks, optimize working capital, and make strategic investment decisions. By transforming raw bookkeeping data into actionable intelligence, SAP empowers finance leaders to become true business partners driving growth and innovation.

Cost Efficiency and Resource Optimization

While the initial investment in SAP bookkeeping services might seem significant, the long-term cost benefits are substantial. Automation reduces the need for extensive manual labor, lowers the risk of costly errors, and accelerates financial close processes.

Moreover, by centralizing financial data and processes, businesses can eliminate redundant systems, reduce software licensing costs, and optimize IT resources. This efficiency enables finance departments to focus on higher-value activities such as strategic planning and financial analysis rather than routine bookkeeping tasks.

Supporting Digital Transformation Initiatives

Digital transformation is a top priority for many organizations, and modernizing financial management is a critical component of that journey. SAP bookkeeping services are cloud-ready, enabling businesses to leverage the scalability, security, and accessibility of cloud platforms.

Cloud-based SAP solutions facilitate remote work, real-time collaboration, and continuous updates without disrupting operations. This flexibility aligns perfectly with today’s hybrid work environments and supports ongoing innovation in financial management.

Real-Life Examples: Success Stories

Numerous companies worldwide have transformed their financial management by adopting SAP bookkeeping services. For instance, a global manufacturing firm streamlined its accounts payable and receivable processes, reducing closing times by 40%. A retail chain improved financial reporting accuracy and compliance across multiple countries, enabling faster expansion decisions.

These success stories demonstrate how SAP bookkeeping services can be tailored to diverse industries and business sizes, delivering measurable results in efficiency, accuracy, and strategic insight.

How to Get Started with SAP Bookkeeping Services

If you’re considering SAP bookkeeping services, the first step is to assess your current financial management challenges and define your goals. Partnering with an experienced SAP implementation consultant can help tailor the solution to your unique business needs.

Training and change management are also critical to ensure your finance team adopts the new system effectively. With the right approach, SAP bookkeeping services can become a cornerstone of your financial strategy, driving innovation and competitive advantage.

Conclusion

SAP bookkeeping services are more than just an accounting tool—they represent a comprehensive financial management platform designed to meet the demands of modern business. From real-time insights and enhanced accuracy to scalability and advanced analytics, SAP transforms bookkeeping into a strategic asset.

For CFOs and finance leaders aiming to improve operational efficiency, ensure compliance, and unlock actionable insights, SAP bookkeeping services offer a compelling solution that can elevate your entire financial management function. Embracing SAP today means preparing your finance department for the challenges and opportunities of tomorrow.