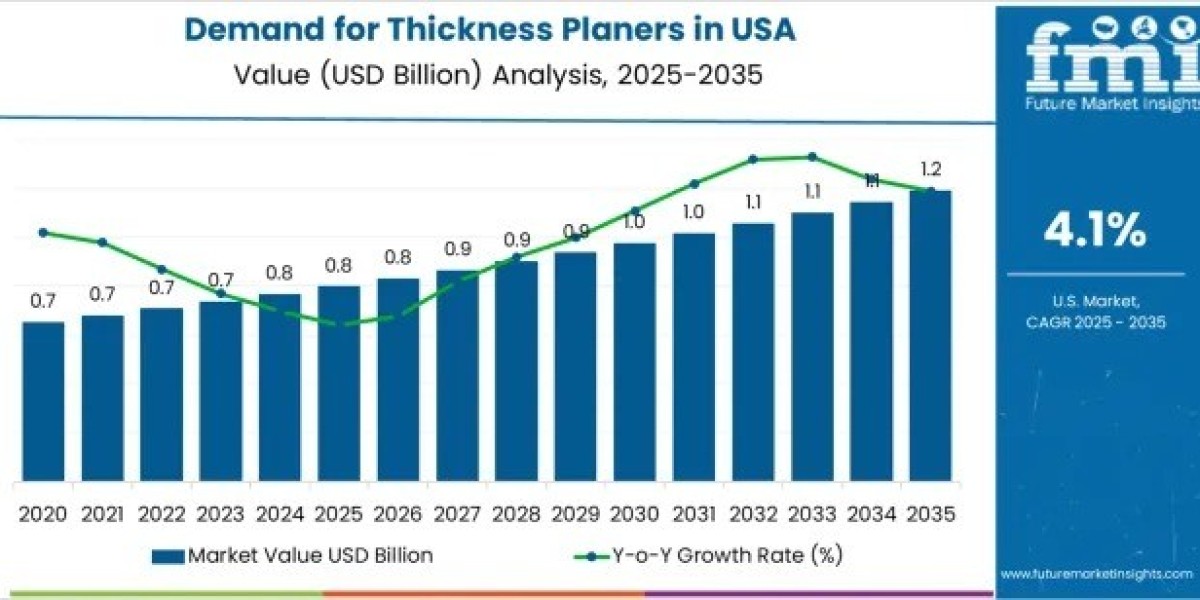

The Demand for Thickness Planers in USA is expected to reach USD 1.2 billion by 2035, up from USD 0.8 billion in 2025, growing at a CAGR of 4.1%. Growth is primarily driven by residential woodworking, furniture manufacturing, and small-scale fabrication. Thickness planers are essential for achieving uniform board dimensions, precise surface finishes, and consistent material preparation across hobbyist, professional, and light-industrial settings.

Subscribe for Year-Round Insights → Stay ahead with quarterly and annual data updates: https://www.futuremarketinsights.com/reports/sample/rep-gb-28676

Key Product Segments Driving Demand

Bench-top Thickness Planers Lead the Market

Bench-top planers dominate with 46% of demand due to compact design, portability, and suitability for small to mid-scale workshops. Heavy-duty planers hold 34% of the market, serving large commercial shops, while handheld units represent 20%, used for quick adjustments and on-site tasks.

Power Source Trends

- Electric planers: 58% share, offering consistent torque and long operational life.

- Battery-powered planers: 27%, favored for mobility and convenience.

- Pneumatic planers: 15%, used in high-torque industrial applications.

End-Use Industry Insights

Furniture Manufacturing Leads

Furniture manufacturing accounts for 39% of demand, driven by precision surface preparation requirements. Construction and carpentry follow with 28%, DIY and hobbyists at 21%, and industrial workshops at 12%. These sectors depend on thickness planers for consistent board thickness, smooth finishes, and reliable surface preparation.

Regional Market Analysis

- West: 4.7% CAGR, driven by hobby woodworkers, home renovations, and small workshops.

- South: 4.2% CAGR, supported by residential construction and woodworking businesses.

- Northeast: 3.8% CAGR, fueled by established woodworking communities and renovation activity.

- Midwest: 3.3% CAGR, reflecting traditional woodworking and small manufacturing hubs.

Market Drivers

- Rising DIY woodworking and home workshop trends.

- Expansion of residential construction and renovation projects.

- Technological improvements in cutterheads, digital depth controls, and dust extraction systems.

Market Restraints

- High initial equipment cost compared with basic tools.

- Slow replacement cycles due to long-lasting machines.

- Competition from alternative finishing tools like sanders and milling services.

Emerging Trends

- Compact, portable planers designed for home and small professional workshops.

- Growing interest in custom wood furniture and reclaimed wood projects.

- Increasing e-commerce sales channels for professional-grade planers and accessories.

Competitive Landscape

The USA thickness planer market is moderately concentrated:

- DeWalt (Stanley Black & Decker, Inc.): Market leader with 28.2% share.

- Makita Corporation: Known for precision, low-vibration planers.

- Bosch Power Tools: Focused on depth control and dust extraction integration.

- JET Tools (JPW Industries, Inc.): Professional-grade planers for continuous-duty operations.

- Grizzly Industrial, Inc.: Cost-efficient units for small shops and hobbyists.

Competition is centered on cutting accuracy, motor durability, snipe control, and user safety features.